Envision a game-changing solution that effortlessly boosts your cash flow by up to 40%, fosters workforce diversity, and optimizes tax credits—all without trimming a single expense. The Work Opportunity Tax Credit (WOTC) is an easy button available for you to push; a tax credit available to all businesses that is an especially good fit for employers in the home care industry. The Work Opportunity Tax Credit exists to give employers substantial tax credits each year that can change the landscape of their business. When the WOTC program is implemented correctly, strategically, and with the right partners, employers can capture enough tax credits to significantly reduce or even eliminate their Federal income tax liabilities.

Work Opportunity Tax Credit, Explained

What is the Work Opportunity Tax Credit (WOTC)?

WOTC (often pronounced “watt-see”) stands for Work Opportunity Tax Credit and is a U.S. government tax credit program that incentivizes employers to hire American jobseekers who have historically faced barriers to employment. Home Care agencies are receiving substantial tax credits each year that can be re-invested in developing caregivers, expanding services, and strengthening the business.

The Work Opportunity Tax Credit was created in 1996 to help drive employment for individuals who have historically faced barriers to employment. The program incentivizes employers in businesses of all sizes to hire individuals that fall within any of nine specific groups recognized by the program to identify jobseekers who have been considered disadvantaged. WOTC is an extension of the “Targeted Jobs Tax Credit” from 1978 and is available (and advantageous) to businesses of all sizes—any business that pays Federal taxes. The program’s effectiveness saw an increase in 2012 with the addition of Electronic Screening. Currently, WOTC is extended through 2025, but there is proposed legislation being considered in 2024 to make WOTC permanent.

Who Qualifies for WOTC?

From TANF recipients to SNAP recipients to Veterans, the home care industry is seeing an above-average percentage of its employees qualify for the Work Opportunity Tax Credit. There are nine different WOTC groups that can qualify a new hire for varying amounts of tax credits to the employer, ranging from $1,300 for Summer Youth Employees living in Empowerment Zones to $9,600 for certain groups of previously unemployed Veterans.

Time is of the essence when looking to apply for Work Opportunity Tax Credits. Every new employee has only 28 days from their start date to complete the WOTC questionnaire, which will identify if they qualify for the credit, and, if so, the maximum credit amount. This is where it becomes imperative to partner with a professional like Rockerbox and utilize an integration like the one available in AxisCare to deliver a simple WOTC questionnaire instantly and seamlessly to the new hire. The questionnaire delivered from Rockerbox through AxisCare takes the employee less than two minutes to complete, and AxisCare has made it easy to track questionnaire completions inside of AxisCare as well.

How Profitable is WOTC?

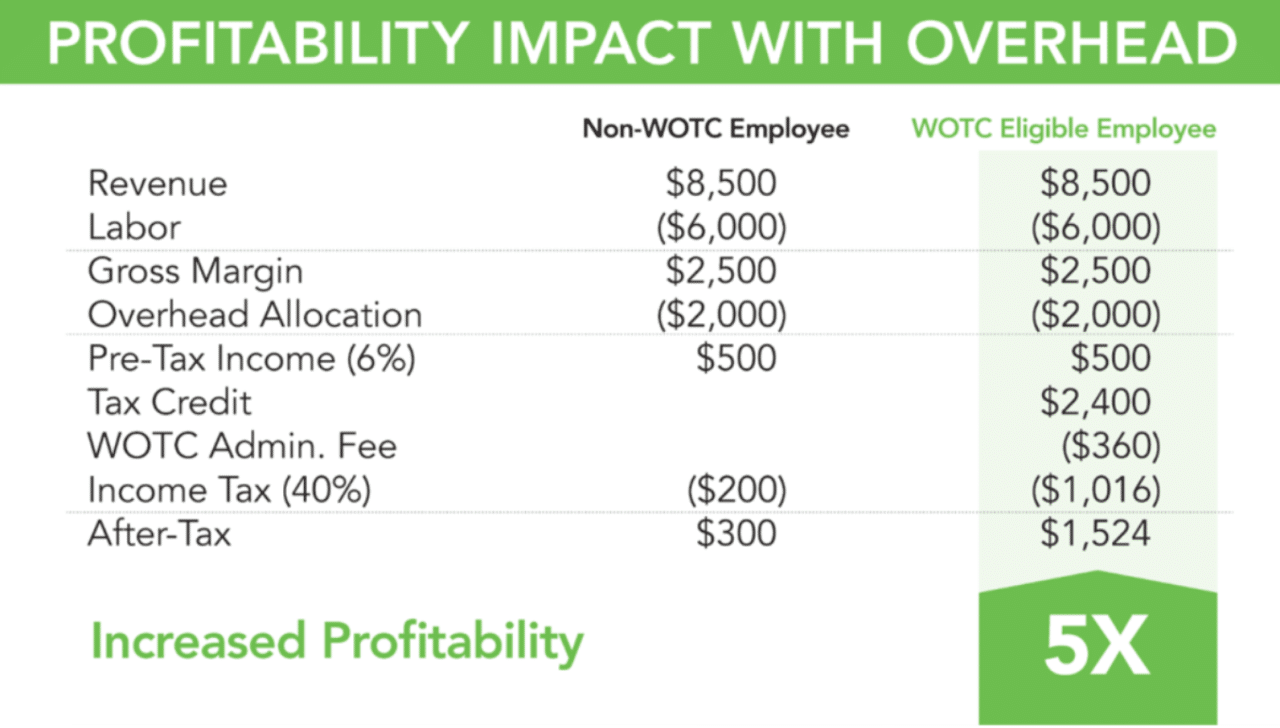

A WOTC-eligible employee is five times more profitable for your agency than a non-WOTC employee. Let’s take a look at a SNAP recipient, who earns a max credit of $2,400 for your home care business. As seen in the graphic below, when working the same number of hours (billing out $8,500 to the client) and at the same pay rate ($6,000 for hours worked), after overhead and taxes, the WOTC-eligible employee will earn your agency a profit more than five times higher than a non-eligible employee.

Hiring from within one of the nine target groups not only makes hiring entry-level and previously unemployed individuals more profitable, but also widens your talent pool. Plus, acquiring new talent into the home care industry helps build loyalty and improve retention rates.

Getting Started With WOTC

Implementing WOTC

Like all tax programs, there are WOTC regulations to understand, forms to submit, and procedures that must be followed. There is paperwork that must be completed and submitted each month to screen applicants and report wages. Countless businesses miss out on huge tax credits simply because they lack the time, manpower, and expertise to take on a new project like this.

But AxisCare has made it incredibly simple for our users through our integration with Rockerbox. The AxisCare Integrations Team will enable the Rockerbox integration on your AxisCare site, allowing the WOTC screening questionnaire to be sent directly to new hires via email and also through their AxisCare Caregiver Mobile App. Your office managers acquire the ability to track questionnaire completion, qualification, projected credit amount, and much more on the robust Work Opportunity Tax Credit Report inside of AxisCare. Between the simple integration and our partnership with the professionals at Rockerbox, AxisCare users can rest easy knowing that they are receiving maximum Work Opportunity Tax Credits with utmost accuracy and minimum user effort.

Who is Rockerbox?

Rockerbox founders, Philip Wentworth and David Young, have almost four decades of combined tax program experience, and their team touts an impressive 100 years of combined experience, ensuring your filing is accurate. Rockerbox assigns each customer a dedicated Customer Success Manager to walk you through any questions. Rockerbox does all the WOTC heavy lifting on your behalf; they even challenge denials and follow –up on documentation to decrease fallout.

To learn more about Rockerbox, WOTC, and the integration with AxisCare, watch this recent webinar with Rockerbox.

Getting Started With AxisCare and Rockerbox

There is no other button you can push or lever you can pull that will optimize your home care business’s cash flow as dramatically as the Work Opportunity Tax Credit. And because your new hires only have 28 days from their start date to submit their WOTC questionnaire, the best day to get started is today.

Book a demo with AxisCare to learn how you can easily integrate with Rockerbox (and many other integrations) to make your business more profitable and your processes more efficient. Save yourself time and headaches when you let the experts do the heavy lifting on your behalf.

If you are already an AxisCare customer, simply click here and enter your info.