Future-Proof Your Finances: Rapid Revenue With Next-Gen Billing

In this webinar we discussed ways to future proof your agency’s finances with next-gen billing. The conversation with partners from AxisCare VA Billing and CardConnect included:

- Setting yourself up for future financial success

- Why and how to diversify your payer sources

- Payer source industry trends

- How to get paid FASTER, minimizing the billing cycle

- Affordable payment methods

- Crisis preparedness

1

00:00:05.203 –> 00:00:26.393

Courtney McCormick: Hi! There and welcome. Good morning. Good afternoon. Wherever you are in the world today we are so thrilled that you are here with us today. You are joining us to learn more about future proofing your finances. We’re gonna be talking about rapid revenue with Nextgen billing. We have a lot of great content.

2

00:00:26.393 –> 00:00:56.112

Courtney McCormick: With a couple just fantastic experts in the field to really dive into some details and some strategy on payer diversification, and really future proofing your finances here. So just a couple housekeeping things as we get started and more attendees join. Today, we are recording this, and we will be sending out the recording later today to everyone who’s here with us and to everyone who registered for this webinar

3

00:00:56.293 –> 00:01:21.303

Courtney McCormick: and we have a QA. Box here. So in this zoom call, instead of using the chat, we’re gonna use that QA. Box at the end of our call today, I’m sure a lot of good questions will come up. They always do when we talk about this. If you guys could just submit your questions throughout into that. QA. We’re gonna be submitting those questions and answering them live at the end of our webinar webinar here.

4

00:01:21.453 –> 00:01:30.052

Courtney McCormick: So let’s dive right in. What are we gonna be talking about today. We’re gonna be talking about payer diversification. What is it?

5

00:01:30.183 –> 00:01:59.393

Courtney McCormick: How is it beneficial? What does it mean? Strategies for that? We’re gonna be diving into private pay. So this is, gonna be really good for those of you who have private pay clients so beneficial. It’s also gonna be really helpful for those of you who do not have private pay clients. And that’s because we want you guys to be thinking about pay or diversification. Where can I expand on my pay or sources. Same thing with veterans, affairs, billing Va. Billing.

6

00:01:59.393 –> 00:02:14.612

Courtney McCormick: So we’re thinking about serving the vets in our community. Great for those of you who serve Va. And Bill to the Va. And great for those of you who thought, Hey, I’ve heard they have incredible reimbursement rates. Is that something I’m interested in. Let’s dive into that today.

7

00:02:14.613 –> 00:02:32.443

Courtney McCormick: We’re also gonna be talking about different billing possibilities for efficiency. That’s my favorite word in the English language. I love efficiency. That’s really the point of my whole job is to save our access care clients, time and money. So we’re gonna dive into that, and then we’ll have A. Q. And A at the end.

8

00:02:32.903 –> 00:02:57.352

Courtney McCormick: So today’s host, I’m Courtney Mccormick. I am the director of integrated partnerships here at Axis. Care like I said, what I get to do all day. Every day is talk with our access, care clients about the different ways that they can save time. They can save money, and in the end they can be more profitable, more successful. And that’s through integrating with different platforms right into axis care.

9

00:02:57.353 –> 00:03:06.562

Courtney McCormick: We’re going to hear from 2 of these people today that have integrations with access care. Let me hand it over to Dylan Seely Dylan. Why don’t you introduce yourself?

10

00:03:07.583 –> 00:03:31.993

Dylan Seley: Hi! Good morning. Thank you, Courtney. Well, my name is Dylan Seely, and I’m the director of Va. Billing at access care. And really, what I get to do is help agency owners or partners understand how the Va. Is and can be beneficial, and how to get paid through the Va and that whole daunting task that is all looming over people’s heads.

11

00:03:32.243 –> 00:04:00.183

Dylan Seley: We have a wonderful solution for that. So and I’ll talk a little bit more about that later. But thank you so much for joining us today, and I can’t wait to talk with you guys further. Thanks, Dylan. I can’t wait to hear your tips and tricks and strategies. Let’s hear from Alex. Introduce yourself here. Thanks so much again for inviting me, Courtney. I love being invited to all things. Access, care, super fun.

12

00:04:00.183 –> 00:04:23.423

Alex Bondarenko: I’ve been in payments for 15 years. In the last 10 years of that I’ve spent exclusively in the home care industry, helping now over 1,500 home care agencies get plugged in and collecting transactions via credit card debit card. Ach! Making sure that they’re compliant, making sure that they get paid quickly that they keep their costs and control.

13

00:04:23.423 –> 00:04:48.322

Alex Bondarenko: There’s just a lot to cover there, and I’m super excited because this is always fun to prepare hopefully. Here we have somebody who’s attending who’s never done private pay, and they’re just like, what do I do? That’s that’s like the the most fun part. And obviously, anybody who’s looking for advice on how to optimize this whole thing. Access care is a tremendous tool that that created a lovely integration to our payment gateway.

14

00:04:48.323 –> 00:04:57.092

Alex Bondarenko: But just II know as an age. If I was an agency owner I would absolutely use that myself. So I’m excited. So

15

00:04:57.093 –> 00:05:06.193

Alex Bondarenko: just you. You let me know what to say when to say, Courtney, and I’ll be right here. I will. Thanks, Alex. Thanks, Dylan. Let’s dive right into everybody.

16

00:05:06.403 –> 00:05:31.383

Courtney McCormick: So when we talk about future proofing your finances, you know this is kind of a buzz word in the home care, industry, and otherwise payer diversification. So we wanna think about, you know, we’re hearing about this 80 20 rule coming out of Medicaid. We’re hearing about different legislation coming down the pipe. Right? We’re hearing about some issues that different people have had getting their reimbursements from various

17

00:05:31.383 –> 00:05:53.672

Courtney McCormick: is Evvv sources. Right? So when you think about how do I have stability in the future? We’re thinking about, how do I diversify where my income is coming from? So we want this to be an interactive session with you guys, we want to hear from you. We’re gonna launch a poll right now. And we want every single one of you guys to answer this question.

18

00:05:53.673 –> 00:06:02.573

Courtney McCormick: So we know that very few homecare agencies are properly diversified. We want to know what pair sources are you currently use utilizing?

19

00:06:02.603 –> 00:06:13.052

Courtney McCormick: So you can mark all of these. You can mark one of them we want to see. Are you use utilizing just one payer source multiple payer sources? You guys let us know

20

00:06:13.573 –> 00:06:17.142

Courtney McCormick: I’m going to leave that up there. And you guys just take your time answering that

21

00:06:17.213 –> 00:06:40.152

Courtney McCormick: another thing that we’re wanting to think about it along with future proofing. Your finances is minimizing the billing cycle. Now, we’re really gonna get into a lot of great tips and tricks. Get out your pencils. Get out your notebooks. We’re gonna hear a lot of good information about this today. So we’re wanting to move away from chasing down checks.

22

00:06:40.153 –> 00:06:51.952

Courtney McCormick: from sending out those paper invoices chasing down checks, waiting forever to money for money to come in trying to pay caregivers. Do I have enough money to cover this payroll

23

00:06:51.953 –> 00:07:01.612

Courtney McCormick: and we’re looking at right now in a like in exchange for that, a trend towards auto pay in the home care industry.

24

00:07:01.773 –> 00:07:26.702

Courtney McCormick: So you know, I know this is something that is a different mindset for some home care agencies, but really a lot of home care agencies, and honestly, the most financially secure agencies are trending towards auto pay for all of their clients. Now you might have some clients who would grandfather into that check writing if they just refuse but one trend that we’re seeing here at access care a lot.

25

00:07:27.033 –> 00:07:40.402

Courtney McCormick: Is that for all new clients, you say, hey, it’s just our policy that we put all of our clients on auto pay. So we take a you know, either an Ach bank draft form of payment

26

00:07:40.403 –> 00:07:57.142

Courtney McCormick: or a credit card. It’s just gonna be autopay that ensures you are always getting payments on time, and really, quickly and simply, Alex will show us how from those private pay clients you’re always going to get those payments. You’re always going to be able to shorten that window

27

00:07:57.143 –> 00:08:01.373

Courtney McCormick: for the billing cycle and really give yourself room to breathe there

28

00:08:01.843 –> 00:08:16.113

Courtney McCormick: and then, finally, what is Nextgen billing next generation billing. That is a move away from that paper process I just mentioned a move toward single click, invoicing and collection. Imagine

29

00:08:16.273 –> 00:08:22.973

Courtney McCormick: if you could click one button and it would send all your invoices, collect all your payments and all your receipts

30

00:08:23.023 –> 00:08:52.283

Courtney McCormick: to everybody. At one time one button. You can do that now you’re that’s available. Now imagine if you could click everybody that’s on long term care insurance. Send it all out and one click, everything you can do that now that ensures accurate, quick, third party payments. So we’re looking at all these ways to move away from this one line item at a time, one service at a time, manually doing invoices, sending them out and waiting for the money.

31

00:08:52.623 –> 00:09:16.163

Courtney McCormick: So that is, you know, I know big picture overview, and I’m ready to dive into some of the more detailed. How do I do it? So, Alex, can you take us into some of you know we’re gonna look at this private pay. I’ve kind of teed you up a little bit here. But we’re looking at in your world. Can you speak to us a little bit about the private pay side?

32

00:09:17.263 –> 00:09:31.863

Alex Bondarenko: Yes, absolutely. And I think with when it comes to payments specifically in home care and private pay. It’s very different from your just traditional merchant processing. Once one size doesn’t fit all, and

33

00:09:31.873 –> 00:09:56.362

Alex Bondarenko: a lot of agencies have probably already experienced the the fatigue of trying to find the right provider, the right solution, the right method of doing things. Because payment processing companies in general typically don’t focus on this industry at all. What they usually look out for much more so is like the point of sale environment for your retail and restaurant industry. That’s where they make the bulk of their money.

34

00:09:56.423 –> 00:10:08.993

That’s where they have all their equipment. That’s where they have all their investments, and no one’s really paying any attention to the card. Not present. No face to face, interaction for for invoicing and billing, especially in the world of homecare.

35

00:10:09.353 –> 00:10:25.203

Alex Bondarenko: where there’s so much risk. And there’s there’s a lot of ongoing conversation with the client. So I say, you know, let’s let’s dive in. So if you go to our first slide, and and we can just kind of go after these 5 different ways. And

36

00:10:25.203 –> 00:10:54.913

Alex Bondarenko: just to, you know, there, there’s probably 20 different ways to future proof. Your private, you know, pay billing. Maybe there is even more than that. But we’re gonna kinda focus on some of the ones that the agency owner can typically kind of take control of and make it happen without waiting on something else to do it for them. And this number one. And the reason why we talk about this one always as the first one is because, believe it or not reducing your own billing cycle is actually up to you, the agency owner. It’s actually the balls in your court.

37

00:10:54.913 –> 00:11:15.012

Alex Bondarenko: Many agency owners will think that. Well, my clients are slow to pay. They’re forgetting to pay their invoices. They’re forgetting to mail their checks. And it’s very inconvenient. So there’s a lot of roadblocks to getting paid quickly. But there’s some really good basic policies that you can set up for yourself to make this much more efficient. So number one focus on that authorization form.

38

00:11:15.013 –> 00:11:29.622

Alex Bondarenko: That’s a tremendous vehicle for making sure that you have control of when you get paid, and when you charge your clients, the language on that form can be very flexible, include it can include a lot of things, and that can make it much stronger. It can talk about the

39

00:11:29.913 –> 00:11:39.663

Alex Bondarenko: notification date like, when am I getting notified of my upcoming bill. When am I actually getting billed? What day are you actually charging my bank account?

40

00:11:39.663 –> 00:12:03.232

Alex Bondarenko: So as you build your authorization form adding those details in there is going to create a lot more awareness between you and your client specifically for your client as to the fact that you are making this easier on them by putting them on auto pay. Okay? So the authorization form is a sale of service to your client rather than more of like a it’s an admin requirement.

41

00:12:03.333 –> 00:12:12.522

Alex Bondarenko: So if you think of it that way and you present it, and you promote it in in that way, you can really make it easier for you, for yourself and your client.

42

00:12:12.953 –> 00:12:28.322

Alex Bondarenko: Obviously, once you have the authorization form in place that has the notification date and the billing date, which is like a very expected date by you and your customer. You can then utilize some something like Bill, and collect to

43

00:12:28.333 –> 00:12:56.943

Alex Bondarenko: in in combination with that to really cut back on time most of our agencies that successfully use access, care, bill and collect. They spend roughly, you know, maybe a minute or so on. Actually, you know, okay, I pushed the button. Did I push the button? Right? Kind of thing, because it is just one button, and then their funds come in quickly, but they they expect they have actual real expectations of when this revenue is coming in.

44

00:12:57.233 –> 00:13:18.902

Alex Bondarenko: let’s go to slide 2 on this one, so that we can talk a little bit about that, that resistance a lot of times with clients actually paying with these methods, such as credit card, a ch debit card a lot of times they’re worried about security. They’re worried about cost. One of the top reasons why somebody doesn’t want to put be put on auto pay a lot of times is because of the cost.

45

00:13:18.903 –> 00:13:42.992

Alex Bondarenko: so make it affordable for your clients by making it affordable for your clients you can kind of on bottleneck that AR that typically gets really really slow. And clients, you know, slowing down their payments. So, for example, utilizing Ach and debit cards as an alternative payment method. This is oftentimes overlooked, but these are both inexpensive payment methods that still get you paid quickly.

46

00:13:42.993 –> 00:13:50.853

Alex Bondarenko: and they’re affordable for your client. You cannot impose a convenience fee on something like an Ach or a debit card

47

00:13:50.853 –> 00:14:08.342

Alex Bondarenko: for the clients, so the client may be much more receptive to paying this way. If you are doing a convenience fee for credit cards, make it reasonable, so you don’t have to hit them with a 3 and a half or a 4%. We see this a lot agencies that charge all the way up to 5% for using a credit card.

48

00:14:08.343 –> 00:14:25.162

You’re creating an environment of decision fatigue for your client. How do I pay now? Because this is now what’s 5% even? What’s 5% of my bill this week. What’s gonna be 5% next week. So now you’re you’re playing this game with your customer when they’re they’re not really on a on a schedule of payment.

49

00:14:25.163 –> 00:14:41.033

Alex Bondarenko: make it really easy for them. Set it to something like a 1.9 9. A lot of our agency clients are doing that it’s a tremendous hack to kind of speed up AR, and it makes credit card processing affordable for you, and it makes it affordable for them as well.

50

00:14:41.053 –> 00:14:59.212

Alex Bondarenko: the last 2 things on this slide. It has to have to do with payment plans and a lot of times we think of payment plans is okay. Well, if they don’t pay me after a certain amount of time I’ll give them a call, and I’ll talk about a payment plan, or we’ll talk about alternative ways of collecting on this invoice.

51

00:14:59.213 –> 00:15:23.702

Alex Bondarenko: That is too late, because at that point the client has gone dark on you. They don’t want to talk to you anymore. There’s money problems, it’s not, it’s it’s a. It’s a difficult situation already. So you want to start talking about payment plans with the client as a tool in their toolbox, as their relationship with with you is still normal when they’re in conversation with you, they’re talking to you. Everything is fine

52

00:15:23.843 –> 00:15:33.002

Alex Bondarenko: doing an a. A. A payment plan offer when they’ve already gone 30 days past. Their due date is is a little bit too late, and it won’t really be received. Well.

53

00:15:33.133 –> 00:15:35.313

Alex Bondarenko: we can hop to the next slide.

54

00:15:36.183 –> 00:15:58.493

Alex Bondarenko: Okay. And this is that my favorite slide. And this is definitely the thing that I’m most excited about. And I over the last 15 years in this industry I have been part of 7 different big integrations for companies like axis, care that want to take to market a really fun and great tool for their clients.

55

00:15:58.493 –> 00:16:19.163

Alex Bondarenko: and by far access. Care is the best, and it has been the most successful with their customers. There’s a reason for that, because that access care team took into strong consideration the money saving and the time saving concepts. They weren’t so big on, just like, okay, let’s just have some kind of functionality that maybe competes with quick books.

56

00:16:19.163 –> 00:16:25.543

Now let’s have something that completely annihilates that as a possibility. And let me show you why.

57

00:16:25.543 –> 00:16:49.972

Alex Bondarenko: So, for example, access care Bill and collect users typically save over 25% on fees from their previous vendor. That’s one of the easiest things for access care to do. But as you go down you see that accepting a debit card in access. Care bill and collect will cost you 78% less than if the exact same debit card for the exact same dollar amount is used in quickbooks, payments. That’s a massive savings.

58

00:16:49.973 –> 00:16:54.433

Alex Bondarenko: Right? So. And this was something that again, the access care team took very seriously.

59

00:16:54.433 –> 00:17:07.113

Alex Bondarenko: How about Ach, a $1,500 Ach, transaction and access care bill and collect will cost you 93 less than the the exact same. 1,500 transaction is processed through quickbooks, payments.

60

00:17:07.363 –> 00:17:13.222

Alex Bondarenko: Okay? And as you go down to the fourth point here, you realize that not only are you saving a tremendous amount

61

00:17:13.433 –> 00:17:27.393

Alex Bondarenko: on fees, but you’re also cutting back on time. So processing a hundred payments in access gear, or, I should say, 100, a thousand, 6,000, it doesn’t really matter how many thousands of payments you have

62

00:17:27.903 –> 00:17:38.172

Alex Bondarenko: you click one button. It’s called Bill and collect, and the system does the rest for you. So, however long it takes you to click a button. That’s how long it’ll take you to run the payments.

63

00:17:38.383 –> 00:18:03.483

Alex Bondarenko: and if you run a hundred invoices in quick books, and Dylan can speak to that, too. It’ll take you roughly an hour and 40 min of manual labor. So whoever you’re paying to do that, whether it be you’re not paying yourself to do it, or you’re paying somebody else to do it. This is definitely a, you know, the the all wheel drive solution when it comes to this area.

64

00:18:03.703 –> 00:18:06.053

Alex Bondarenko: So next slide.

65

00:18:06.883 –> 00:18:21.752

Alex Bondarenko: okay? And that we’ve talked a little bit about some of the really great benefits right? And there’s a lot more to cover. And I really encourage everybody that hasn’t seen access care, Bill, and collect to reach out to Courtney afterwards and see a demo. It’s fantastic.

66

00:18:22.173 –> 00:18:49.602

Alex Bondarenko: but be prepared for problems. This is where we see a lot of agencies that want to dive into private pay, or they they maybe got kind of. They fell into private pay, and it just happened. And now it’s blowing up and it’s fantastic. It’s a great revenue source, but they’re not prepared for problems. And some of the top things we see is just the lack of organization. Specifically, when it comes to authorization, form storage. How you keep them? Are they up to date

67

00:18:49.603 –> 00:19:07.402

Alex Bondarenko: and are, are the authorization forms readily available? The very as soon as a a dispute occurs, one of your clients may go back to their bank and question the transactions or maybe, you know, there was a dispute between you and the client. In some way

68

00:19:07.403 –> 00:19:25.553

Alex Bondarenko: the bank is going to require an authorization form for disputing this transaction specifically when it comes to credit cards. With Ach, things are a little bit different because they they’re governed by certain banking rules. And Ach! Authorization forms only kick in after a certain period of time.

69

00:19:25.553 –> 00:19:50.492

Alex Bondarenko: But you have to have these forms readily available. Okay, then the other thing is, keep your merchant processing personal account manager on speed dial, and if you don’t have a merchant processing personal account manager, then definitely get a a personal account manager, because most times people call the 1 800 good luck. And then all of a sudden, they’re stuck in some kind of a ticketing queue, and it’s several days before the company even figures out what it is

70

00:19:50.493 –> 00:19:58.542

Alex Bondarenko: that you want from them. Right? So the personal account manager is more of a translator. You kind of half express your need.

71

00:19:58.543 –> 00:20:14.893

Alex Bondarenko: and they can fill in the rest to the team that’s required to do that. What’s really fun about access care, Bill, and collect is you don’t get just one. You get 2 of these account representatives. I’m one of them and you actually can just reach out to someone directly and get some help. And then

72

00:20:15.143 –> 00:20:42.652

Alex Bondarenko: you want to dispute you. I’m sorry you want to do everything in writing with your client. Okay? So that even if they just call you and they’re like, Hey, don’t charge this particular card. Why don’t you charge another card this week, or something like that, or they close this bank account. I wanna use another one. Do all of that in writing. Never, ever accept these verbal changes and then outline your dispute resolution process on your authorization form.

73

00:20:42.933 –> 00:20:59.232

Alex Bondarenko: Don’t bury it somewhere in your contract that they won’t read. Put it right there on page one top of the page, if you want to, because your clients should be coming to you with their dispute problems, not calling their bank. That’s what typically results in in some of the bigger problems that we see.

74

00:20:59.233 –> 00:21:25.462

Alex Bondarenko: Okay? And then let’s go to the last slide. This one’s fun for me. This is more talking about. Like if you’re brand new to private pay, let’s just say you’ve never done this before. This is an area that I feel very strongly about as preparing an agency for venturing into private pay, because there’s so much that you can do to prevent some headaches down the road. So number one, discuss your discuss payment with the client during their onboarding.

75

00:21:25.463 –> 00:21:42.992

Alex Bondarenko: People want to skip this part because they’d like for the sales process to keep moving for the onboarding experience to go smooth. You’re here to, you know, alleviate their problems. Not talk about money, you know. Talk about the money stuff. Okay? And in that same conversation require everybody to be on auto pay

76

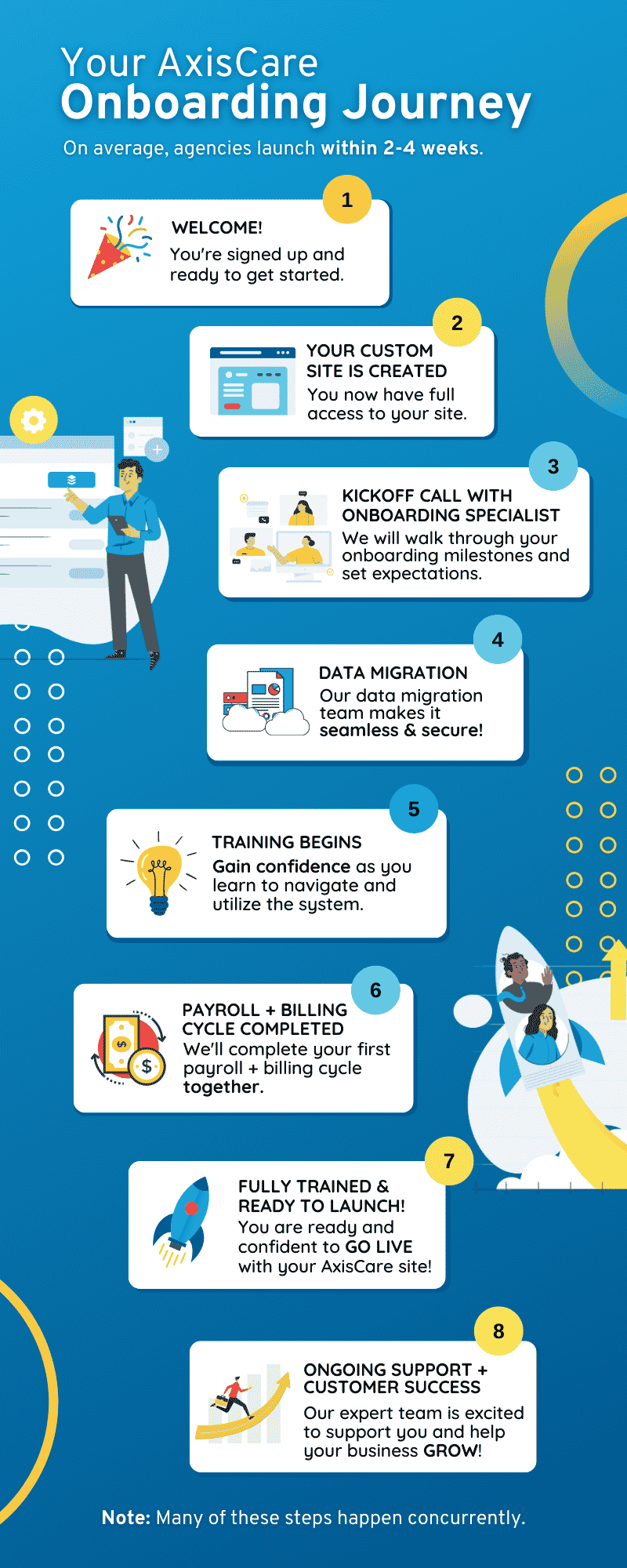

00:21:42.993 –> 00:22:07.022

Alex Bondarenko: once you if you make that a requirement or a company policy on your part as well as a service that you offer to all your clients to make it easier for them. Just by power of suggestion. You’re gonna have a really high adoption rate. If you leave this out completely, they will try to pay. However, they want whenever they want, and you have trickle in money rather than expected

77

00:22:07.023 –> 00:22:14.153

calculated revenue that you know. Exactly. Okay. On Wednesday I’m getting $50,000 because I push the button.

78

00:22:14.623 –> 00:22:15.613

Alex Bondarenko: Okay.

79

00:22:15.723 –> 00:22:28.543

Alex Bondarenko: beware of slow funding times. So if you’re not using access, care, Bill, and collect, take up to a week for you to get your money. Okay, that’s that defeats the whole purpose of of getting getting things done quickly.

80

00:22:28.573 –> 00:22:43.163

Alex Bondarenko: chargebacks happen. Always be ready with documentation. If you haven’t had one happen yet, it will at some point, because that’s what people do. They call their bank, and they complain about transactions they don’t recognize, or something they weren’t happy about

81

00:22:43.553 –> 00:22:59.102

Alex Bondarenko: and then, of course, be mindful of the credit card processing fees. It’s not uncommon nowadays to run into a merchant account with a 5% fee on it. Okay, we see it all the time. People come to us when they see that access gear has an integrated solution.

82

00:22:59.103 –> 00:23:13.943

Alex Bondarenko: And they they are currently paying 5. So typically, if you’re within that 2.6 to 3% range you’re doing pretty good. But again, the key here is not only to be priced well, but also to save a ton of time.

83

00:23:14.133 –> 00:23:43.143

Alex Bondarenko: and then the last piece. This is something that I strongly encourage for people to pay attention to always keep money in the bank for things like Ach! Returns, chargebacks and merchant fees. So people like to clear out their operating accounts and leave almost nothing in there. But if there’s an Ach! Return, and that money cannot be taken out of your account, and and as always this, you know the extra flavor there is that this happens like the day before. Payroll.

84

00:23:43.383 –> 00:24:11.072

Alex Bondarenko: it can freeze your bank account or or freeze your merchant account so it can essentially prevent any additional money to coming into the bank account until you get a letter from your bank clearing up this mess right? So keep money in the bank. Make sure that you have a a healthy balance in there for anything like that. That would be one of the strongest pieces of advice that I could give to anyone just diving into private pay as a as a new one. And

85

00:24:12.043 –> 00:24:20.202

Alex Bondarenko: hopefully, that was enough information to get to get you guys started on but if you have any additional questions you can always reach out directly.

86

00:24:20.433 –> 00:24:46.762

Courtney McCormick: Thanks so much. Alex, yeah. That felt like a a speed. Amazing crash course and private pay is awesome. We are sending out the recording. So you guys will have this. But if you guys have questions. I know that some questions came up for me about authorization forms, about chargebacks. Just drop them in the QA. We’re gonna pick Alex’s brain at the end here, and kind of get into some more specifics about

87

00:24:46.763 –> 00:25:00.393

Courtney McCormick: legalities. Potentially, these are questions that are coming up for me about percentages. And what can we charge, and what are the legalities? So I’m sure if I’m thinking these things that my friends on the on the call are as well

88

00:25:00.393 –> 00:25:21.243

Courtney McCormick: but for now let’s keep rolling. Dylan, we wanna hear from you. So the the point of this of this call, this webinar is to think about. Okay, what are my different options here to really think about all these different ways I can add in new payer sources. So if you’re someone who’s already billing to the Va.

89

00:25:21.243 –> 00:25:39.523

Courtney McCormick: You’re gonna get a lot of good tips and tricks if you’re someone who’s not yet billing to the Va. Tune in. Now watch your screen. Listen to this expert. This is free gold for you from Dylan. He’s the best Va expert I know. So, Dylan, what do you have to share with us today.

90

00:25:40.543 –> 00:26:07.922

Dylan Seley: Yeah, thanks, Courtney, so much. Yes, we’re gonna dive in today. We’ve got a lot of information to cover. But what you know, we really want to hone in on is diversification in all areas. And so let’s dive in. We’ve got a lot to cover. Let’s go to the next slide here. As an agency owner. You need to be ready for the worst case scenario. Right? That’s business 101.

91

00:26:07.923 –> 00:26:14.623

Dylan Seley: That’s what we’ve all heard about from the beginning, that is, you know, you’ve got to be ready for.

92

00:26:14.813 –> 00:26:24.613

Dylan Seley: you know, crisis or non payments, or you know, hey? My payroll is tomorrow. How am I going to pay our caregivers? So

93

00:26:24.613 –> 00:26:47.143

Dylan Seley: you know, we’re gonna talk about? And Alex did a wonderful job about talking about private pay. But there are other lucrative income streams that I’ll just touch on one being the Va. Of course we’ll talk about that today. The other Ltc Medicaid and then there are additional, you know, income sources.

94

00:26:47.143 –> 00:26:54.543

Dylan Seley: even. Va, different waiver programs as well. So you know what we really want to

95

00:26:54.753 –> 00:26:56.982

Dylan Seley: step I can consider is.

96

00:26:57.833 –> 00:27:04.463

Dylan Seley: how can I diversify my business? Right? So has any, as any financial advisor would tell you.

97

00:27:04.583 –> 00:27:09.053

Dylan Seley: diversify right, diversify your accounts. Make sure you have

98

00:27:09.253 –> 00:27:36.232

Dylan Seley: all, not all of your eggs in one basket, and we are really setting ourselves up for success here. So one payer source will not suffice anymore. So in the climate that we live, if you’re only taking private pay clients, you’re missing out right? So va clients, medicaid clients. You want to be putting yourself in a position where, if something happens.

99

00:27:36.293 –> 00:27:41.962

Dylan Seley: if Medicaid doesn’t pay, if you know Va. For whatever reason doesn’t pay, if

100

00:27:42.023 –> 00:27:45.953

Dylan Seley: long-term care doesn’t pay. You have a backup plan.

101

00:27:46.013 –> 00:28:06.873

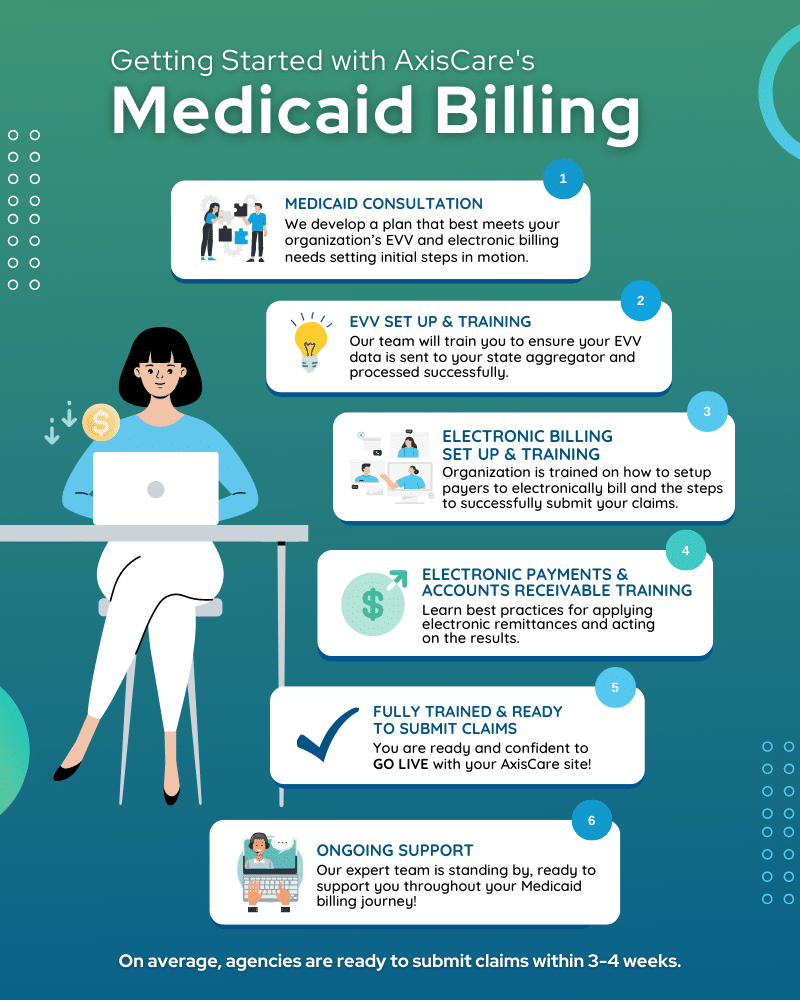

Dylan Seley: So let’s dive in a little bit more and go to the next slide. So the program that we help with the most? And like I said, I work with a lot of homecare agencies with veterans, and that is primarily what our program was designed for is

102

00:28:07.173 –> 00:28:28.403

Dylan Seley: helping providers with the Va. And so this is called the Homemaker Home Health Aid Program. It’s the community care network. A lot of people know it by that. But there is a huge network of veterans out there. So currently, in the United States, there’s approximately 18 million veterans

103

00:28:28.543 –> 00:28:37.592

Dylan Seley: of that 18 8 million are over 65. So that is generally the population needing home health care.

104

00:28:37.733 –> 00:28:54.583

Dylan Seley: and then only a hundred 60,000 are actually using the home health a program. So the landscape is. you know, very, very large. There is a need and there will continue to be a need. Experts

105

00:28:54.623 –> 00:28:57.403

Dylan Seley: go on and on and on about how

106

00:28:57.483 –> 00:29:07.722

Dylan Seley: you know. Within the next 1020, 30 years there is going to be a need to service veterans, right. So the VA. Is going to be

107

00:29:07.793 –> 00:29:29.033

Dylan Seley: over flooded with veterans who need and qualify for home healthcare services, personal home care services, and they are going to need help, and, like Courtney, mentioned at the very beginning, rates are very good, and so that is a very, very nice Perk.

108

00:29:29.063 –> 00:29:36.093

Dylan Seley: that you know, agencies can say, Hey, I can do a note worthy thing, and help our veterans, which is wonderful.

109

00:29:36.253 –> 00:29:52.953

Dylan Seley: but also I can get reimbursed at a good fair rate, and that is going to help solidify my business that is going to put me on track to grow. We have had so many cases. Courtney and I have talked to so many people over the years that

110

00:29:52.963 –> 00:29:57.152

Dylan Seley: have really doubled and tripled their business because of.

111

00:29:57.673 –> 00:30:08.052

Dylan Seley: you know, being able to take veteran clients as an example. Now, the one caveat to this is that you do have to be a provider

112

00:30:08.053 –> 00:30:31.123

Dylan Seley: a contracted and credential provider, if with either try West or optum and so that would be the first step in if you were interested in helping and serving veterans. That would be the first thing to do is get a hold of Tri West or opt them to see if you qualify and participate, to participate in that network.

113

00:30:31.333 –> 00:30:34.283

Dylan Seley: Let’s go to the next slide.

114

00:30:34.683 –> 00:30:38.782

Dylan Seley: You know, I talked to folks with

115

00:30:38.983 –> 00:30:53.043

Dylan Seley: you know, agency owners that have been doing this themselves. They have, decided, you know you know it. It’s not working. And there is a point in time where you have to

116

00:30:53.103 –> 00:31:07.743

Dylan Seley: understand. That, you know, billing is a full time job. And so because of that, there are so many problems that happen, you know, because

117

00:31:07.913 –> 00:31:28.172

Dylan Seley: billing problems equal like it says at the top, it equals you’re not getting paid right? So that sets you back that sets you back from being able to make payroll that sets you back just in a variety of different things. So it’s difficult to set up payers. How are you gonna get set up with tri West. How are you? Gonna get up!

118

00:31:28.273 –> 00:31:34.622

Dylan Seley: Set up with optum. There are a multitude of steps from the beginning to the end

119

00:31:34.693 –> 00:31:46.542

Dylan Seley: rejections, partial payments. You, Bill. $100. You only get 50 back. There are a numerous amount of codes that go into actually getting paid.

120

00:31:46.543 –> 00:32:06.713

Dylan Seley: We’re not, you know, simply sending claims back. But we’re actually coding it in a way that the system the computer systems recognize. And so that if you’re not a professional coder or didn’t do this for study this in college or or whatever it may be. You may not be

121

00:32:06.743 –> 00:32:25.822

Dylan Seley: privy to a lot of those codes. Submitting electronically or paper. That’s a decision you have to make. And we, you know, we have chosen to send obviously, all claims electronically, but there are ever changing codes, and it does take a lot of time if you haven’t done billing before.

122

00:32:25.963 –> 00:32:27.923

Dylan Seley: It is a time.

123

00:32:28.073 –> 00:32:47.763

Dylan Seley: you know, you are going to be in the weeks to do it. And so what we have is a team of people that that’s what they specialize in. And we’ll talk a little bit more about that in a little bit. In turn, though I do like to point out that you know, with the Va. The Va.

124

00:32:47.913 –> 00:32:50.453

Dylan Seley: Does keep tabs of providers that

125

00:32:50.473 –> 00:32:55.403

Dylan Seley: do have excellent care for their veterans, but are also taking

126

00:32:55.423 –> 00:33:05.572

Dylan Seley: the back end very seriously. And so, if we are if your agency is taking care of your veterans and billing cleanly.

127

00:33:05.583 –> 00:33:23.642

Dylan Seley: They are very apt to continue working with you. They want providers that are serious about taking care of their veterans, and also doing the billing correctly. And so because if you’re doing it yourself, or you’re having another person, do it

128

00:33:23.643 –> 00:33:51.353

Dylan Seley: maybe they you or they are not doing a a great job. You know you’re gonna be hesitant to take new clients, because if you’re not getting paid. Now you don’t wanna go take 20 more clients. That’s only gonna put you deeper in the whole. So and then in turn, that also creates a bad relationship with the Va and so what we really want to do is take all of this off your plate, and so let’s go to the next slide.

129

00:33:51.823 –> 00:34:01.222

Dylan Seley: and we will talk about the solution. So we have created axis curve Va billing. And it is a wonderful

130

00:34:01.293 –> 00:34:06.583

Dylan Seley: product. Because what you’re going to do is you’re going to outsource

131

00:34:07.093 –> 00:34:27.793

Dylan Seley: everything. VA. Billing to access care. We are going to take care of. Step A to Z, and we are going to ensure that you actually get the chance to grow your business, and that is the most exciting, liberating feeling for agency owners, because they actually get to grow their business and do what they

132

00:34:27.793 –> 00:34:47.682

Dylan Seley: they were destined to do and not be billers. Right? So we’re gonna we’re y’all are gonna rely on us as the trustworthy source here that’s focusing on getting you paid, and that is our job. Let’s go to the next slide. Just briefly, I wanna touch on our

133

00:34:47.783 –> 00:35:08.963

Dylan Seley: process. And so we call it a white glove process here at access care? Because we do everything for you. This is the vip treatment. So what you are responsible for in the left column the agency is going to get the referrals from the Va. Right. The Va sends you the provider, the referral paperwork.

134

00:35:09.043 –> 00:35:12.763

Dylan Seley: Next you will upload that into access, care

135

00:35:12.813 –> 00:35:22.903

Dylan Seley: into documents, and then let us know when you have a new veteran, a change in authorization or anything like that. And so the best

136

00:35:23.083 –> 00:35:27.363

Dylan Seley: part of all of this is that you’re going to have

137

00:35:27.423 –> 00:35:28.433

Dylan Seley: one

138

00:35:28.553 –> 00:35:31.472

Dylan Seley: point of communication. And so

139

00:35:31.483 –> 00:35:45.062

Dylan Seley: there is no 800 number. There is no dial by code extension. There is none of that. You’re going to have a direct line and a direct email to your biller. And so

140

00:35:45.113 –> 00:35:46.703

Dylan Seley: the handoff in that

141

00:35:46.743 –> 00:36:06.863

Dylan Seley: it’s exactly what’s listed on the right side. So we’re gonna establish a billing frequency. We’re gonna Bill automatically. If you say I wanna Bill every Tuesday it will be done. Every Tuesday you’ll get a report showing what was billed. The dollar amount and all of that will be sent out that business day.

142

00:36:06.963 –> 00:36:16.092

Dylan Seley: We monitor all rejections. We send corrected claims. We even submit appeals on your behalf, and that’s all included in this pricing.

143

00:36:16.193 –> 00:36:42.483

Dylan Seley: So it honestly is. Step a to Z. Our billers come in every morning, and that’s what they do. Is they look at rejected claims. If there’s anything that has rejected anything that has denied that the evening before, we’ll send it right back, we’ll contact Tri West. We’ll call optimum if they need anything that needy that is needing to be done with a claim, we will handle all of that.

144

00:36:42.493 –> 00:36:51.662

Dylan Seley: The funds go straight to your bank. We don’t hold any funds. We don’t advance any funds, so the money will go straight to your bank and

145

00:36:51.753 –> 00:37:02.163

Dylan Seley: approximately 8 to 10 days, which is huge. So what we really like to do is take a look at what our clients

146

00:37:02.203 –> 00:37:25.833

Dylan Seley: cash flow looks like right now, and how we can maximize that, and those are conversations that we will have. In your onboarding call with us. And so you know, we what we really want to do is set you guys up for success, and while we are not guaranteed payment at a certain day at a certain time, what we are saying is is we want to make sure that

147

00:37:26.383 –> 00:37:47.412

Dylan Seley: if you bill weekly, we’re going to also send your claims out to the Va. And we wanna ensure that that schedule is timely and it is anticipated. And so what you’re gonna get with us is stability with your cash flow, and so that is going to be huge for your business.

148

00:37:47.633 –> 00:37:50.903

Dylan Seley: We also apply payments in access care.

149

00:37:50.913 –> 00:38:12.962

Dylan Seley: So a lot of people I get a lot of questions about, you know. How do I? How do I do the back end of it? My AR is just a mess. And so this is what is so cool is that access here has created a payment application. So once the payment comes in, once that money has dropped into your bank account.

150

00:38:12.963 –> 00:38:24.912

Dylan Seley: we go in and go in and apply all of those payments. So it’s marking all of your invoices paid, and then that will sync to quick books or whatever software that you use for your accounting.

151

00:38:25.303 –> 00:38:35.862

Dylan Seley: Very, very nice. You could have a glimpse of your AR at your at your point of view in seconds. It is. It is really beautiful.

152

00:38:35.863 –> 00:39:03.793

Dylan Seley: And we’ll lastly, will also notify you of upcoming authorizations. And so, because of that, you know, it’s very easy for a clients authorization to come up quicker than expected. And what we don’t wanna happen is there to be a gap where you’re not getting paid? And so we have created this reminder that lets you know in advance, quarterly what is coming up.

153

00:39:03.923 –> 00:39:27.942

Dylan Seley: And so maybe that veteran needs to go back in. Maybe that veteran needs to be reevaluated. We want to make sure we give you everything we have. And so you know of what’s coming. And so there are no surprises that veteran should be reevaluated, they should get new paperwork, and that can be uploaded, and then the process continues for that client.

154

00:39:28.053 –> 00:39:35.103

Dylan Seley: Let’s go to the next slide. And so, you know, we’ve talked a lot about

155

00:39:35.733 –> 00:39:37.553

Dylan Seley: diversification.

156

00:39:37.593 –> 00:39:44.682

Dylan Seley: We’ve talked about how the Va works with access care inside access care, our white glove service.

157

00:39:44.713 –> 00:39:48.243

Dylan Seley: But I do just wanna touch on.

158

00:39:48.283 –> 00:39:51.273

Dylan Seley: you know, as an owner, you know.

159

00:39:51.393 –> 00:40:04.252

Dylan Seley: you’re involved heavily in your day to day business, right? There are so many questions. There are so many moving parts you’re hiring. You are taking care of.

160

00:40:04.743 –> 00:40:09.333

Dylan Seley: a numerous population of of folks. But

161

00:40:09.373 –> 00:40:36.413

Dylan Seley: the biggest thing here that we want to touch on and really hone in on is diversification. And so, you know, I would challenge you like, do you have an emergency fund for these things that could come up. That is a a another option to. Just to consider when you’re thinking of diversifying with Va with Medicaid, with private pay with Ltc, but also, you know, do you have an emergency fund to cover you in?

162

00:40:36.533 –> 00:40:55.633

Dylan Seley: you know, potential seasons of drought? And also find alternate payment methods like Va is a great one. There are a couple of other waiver programs in the Va. That can also be advantageous for home care providers. The the

163

00:40:56.123 –> 00:41:17.792

Dylan Seley: the view from today, looking at home, care in the next 10 and 20 years is, it’s bright guys. So like, there are a lot of moving pieces going into home care, legislation, things that are really, really going to impact the home care industry. And so we are on the cutting edge of

164

00:41:18.163 –> 00:41:25.153

Dylan Seley: a just a multitude of bills, things that are going to really open up

165

00:41:25.433 –> 00:41:39.933

Dylan Seley: for home care. And so we’re very optimistic about that and so you know, really, the Va has programs like I said to assist with all of this. And and what we primarily focus on is Va

166

00:41:39.943 –> 00:41:46.562

Dylan Seley: billing. But as far as diversification goes, you know, we really want

167

00:41:46.673 –> 00:41:50.112

Dylan Seley: to just to talk about what is going

168

00:41:50.503 –> 00:42:05.412

Dylan Seley: what is going on currently. And how can we better put everyone in a better situation? So that is what I have today. I wanted to share that with you guys. And thank you so much. Courtney.

169

00:42:05.543 –> 00:42:28.412

Courtney McCormick: Yeah, thanks so much. So you know, I wanna have leave some time here to get to everyone’s questions. But just to recap what you know, what we’re hearing and what we’re seeing and what we know to be true, just like, Dylan said, is that you are in the driver’s seat of your business’s success and failure. This is similar to what Alex. What you said earlier on about you know.

170

00:42:28.413 –> 00:42:36.493

Courtney McCormick: we can take 2 different views of this, either complaining. Oh, no one ever gets their checks in on time, and I’m just waiting here for checks. But really

171

00:42:36.493 –> 00:43:00.062

Courtney McCormick: the agency owner and the agency leader is in the driver seat of how you get paid when you get paid, and whether you’re setting yourself up for financial stability as things ebb and flow on the legislation floor. So I know we have like a question right now about, you know Medicare Medicaid bills that are on floor right now. Things are changing rules that are proposed. But

172

00:43:00.063 –> 00:43:14.733

Courtney McCormick: truly, what Dylan said, that the future of home care is bright. We have more and more seniors moving to in-home care. It is trending towards that. And we have an ever increasing population of seniors in America.

173

00:43:14.733 –> 00:43:19.373

Courtney McCormick: Every day, every month that number of seniors in America increases.

174

00:43:19.373 –> 00:43:38.812

Courtney McCormick: So just super fast other possibilities for efficiency in your pay source diversification. So long-term care insurance. Okay? So this can be a nightmare, a headache, the one by 1, one at a time, inside access care. I don’t know if you guys are aware of this or not.

175

00:43:38.813 –> 00:43:53.322

Courtney McCormick: But inside access care. You have an Efax option. It’s built right inside of of that invoice option. It’s all mixed together with the billing collect system that Alex was talking about.

176

00:43:53.323 –> 00:44:12.482

Courtney McCormick: and you can send with one click. You can fax off to all of your long-term care insurance companies, all of the invoices with care notes. You can separate out what percentage or dollar amount the clients responsible for what percentage or dollar amount the long-term Care insurance company is responsible for

177

00:44:12.483 –> 00:44:13.733

Courtney McCormick: one thing you’re done.

178

00:44:13.903 –> 00:44:21.513

Courtney McCormick: Stop wasting your time. This is what Dylan was just saying. It’s so exciting, you know, for you guys as agency owners

179

00:44:21.803 –> 00:44:33.253

Courtney McCormick: in order. You’re in the driver’s seat of your success in order to be successful, you have got to get out of a job. Don’t give yourself a job. own a business.

180

00:44:33.273 –> 00:44:48.532

Courtney McCormick: be a business owner, don’t create a job for yourself. Create a business for yourself. That means getting out of the weeds getting out of the I’m in the billing seat doing invoices once one invoice at a time, or sending out these long

181

00:44:48.533 –> 00:45:14.613

Courtney McCormick: one click, and that’s it, or you outsource just a professional like Dylan. So you can make a lot more money. Stop the rejection, stop the denials, and you get paid a lot more, and you just have that efficiency where the Va. Loves you and they increase like Dylan said, we’ve seen a 300 increase with clients who started using access care Va. Billing a 300 increase in their number of veterans. So

182

00:45:14.673 –> 00:45:23.513

Courtney McCormick: that’s my big advice for agency owners. Another way to be more efficient. We have preset templates for your payroll.

183

00:45:23.513 –> 00:45:46.433

Courtney McCormick: So you can simplify that billing payroll cycle. Okay? So we’re talking a lot about minimizing that billing cycle. So if you’re thinking about, you’re getting all of your money in in auto pay. You know what day your money’s coming into your account cause it’s on that auto pay. Then you have that same possibility. There, too. You’re not manually doing your payroll. You’re just pulling your payroll, batch

184

00:45:46.433 –> 00:46:03.203

Courtney McCormick: access care does it for you. We have so many presets inside of access care that you can configure. To say our hourly rate on holidays is going to be plus this. And if you work with this client, it’s plus that, and you can do so many configurable options inside there

185

00:46:03.243 –> 00:46:04.423

and then, finally.

186

00:46:05.383 –> 00:46:10.682

Courtney McCormick: how will you ever grow unless you track what you are doing?

187

00:46:11.133 –> 00:46:12.953

Courtney McCormick: You won’t.

188

00:46:13.033 –> 00:46:29.003

Courtney McCormick: If you want to grow, you need to know what your trends are. What have you been doing? What buzz your gross profit margin for each payer source. If I took you guys off mute and ask each of one of you right now, what’s your gross profit margin for each one of your payer sources. Would you know it?

189

00:46:29.773 –> 00:46:39.082

Courtney McCormick: Okay, so we have business intelligence at access care. I would love for you guys to send me an email integrations at accesscare com. I’ll put it on the screen in a minute.

190

00:46:39.123 –> 00:46:49.712

Courtney McCormick: You’re going to be able to track your gross profit margin, and we can show you how to do that by payer source. It is a way that you only improve what you track.

191

00:46:49.763 –> 00:47:07.702

Courtney McCormick: And so if you really want to grow your business, you need to be tracking. How are each one of these things doing? What is my gross profit? Margin by pay or source by region? You can track all these different things. And we wanna partner with you guys to help you grow. Cause when you’re successful, we’re successful.

192

00:47:07.843 –> 00:47:35.982

Courtney McCormick: So let’s get you guys started. We’re gonna launch another poll. We’re gonna end this like, we started it with some interaction. So diversifying leads to increased financial stability. Not so we’ve been hammering in this whole webinar in the face of economic uncertainty, so are you ready to future proof your finances, so you can mark here if you want to know more about Bill and collect if you wanna know more about va billing

193

00:47:35.983 –> 00:47:55.433

Courtney McCormick: and you can mark both of those if you want to know more about both of those, and we’ll do all the heavy lifting for you. It’s super easy to get started with either one of these. You can also send me an email there. integrations@accesscarego.com goes to myself and my team so you’re welcome to send me an email a at that email address.

194

00:47:55.513 –> 00:48:04.732

And we are going to go ahead and hop into some questions because we have lots of great questions and only about 10 min left. I’m going to leave that email address on the screen.

195

00:48:04.973 –> 00:48:09.462

Courtney McCormick: So Alex and Dylan, I’m just gonna kinda

196

00:48:09.533 –> 00:48:23.912

Courtney McCormick: pop some questions at you. Some of the questions we’re trying to answer, some we may or may not get to. If we don’t get to your question, we’ll try to answer it at the personally, one on one after the webinar is done.

197

00:48:23.953 –> 00:48:36.753

Courtney McCormick: So here’s a question as homecare has become more prevalent. Will private insurance companies be covering home care anytime soon. So this is private

198

00:48:37.073 –> 00:48:44.273

Courtney McCormick: insurance companies as opposed to long-term care insurance. I don’t know. Dylan, Alex, do you guys have any thoughts on that.

199

00:48:46.743 –> 00:48:49.702

Alex Bondarenko: I’m not an expert on insurance, but I

200

00:48:49.763 –> 00:49:00.553

Alex Bondarenko: I mean it. It’s it’s very. It’s a very different. II don’t know if they can’t specialize in in other things outside of long term care.

201

00:49:00.643 –> 00:49:13.013

Alex Bondarenko: Because of the amount of payouts that happen in that insurance is very different type of insurance. And it’s it’s, you know, a lot of other interest has

202

00:49:13.033 –> 00:49:34.432

Alex Bondarenko: has funds that that never, ever get touched in long term care or care insurance, especially in progressive care like this, where you kinda know it’s coming, and you kinda know that it’s going to only be needed more and more. I don’t. I haven’t seen of anything in terms of private insurance. What I have seen, however, is

203

00:49:35.023 –> 00:49:37.042

Alex Bondarenko: for a new type of

204

00:49:37.153 –> 00:49:53.873

Alex Bondarenko: payment method, where it’s a digital card where you’re able to issue a card against your own insurance policy. And this is new things that are kind of rolling out. Where, if you do have an insurance policy that has cash value.

205

00:49:53.873 –> 00:50:21.823

Alex Bondarenko: You can issue an actual like a visa card that can be only used to pay for something like this, medical expenses. Home care. So almost like a very, very unique HA. Hsa type card that you can issue against your own policy. There. There are things like that that are coming on the market. There is a company that’s working on even doing where you can actually tap into your home equity and put it on a special type of card.

206

00:50:21.823 –> 00:50:28.922

Alex Bondarenko: That can be only used for this purpose. So there are solutions rolling out. I think the world is acutely aware

207

00:50:28.923 –> 00:50:54.492

Alex Bondarenko: that there needs to be more options and that there’s a big time incoming affordability crisis when it comes to this stuff. And a lot of people are sitting on, you know, things like home equity or cash values in their policies where they could potentially use them. So I don’t know if that answers, yep, Alex, I’m gonna throw back to you right away. Another question, can my authorization form be reviewed to see if it’s okay.

208

00:50:54.773 –> 00:50:57.023

Alex Bondarenko: yeah, absolutely. You can send it to me.

209

00:50:57.193 –> 00:51:26.393

Alex Bondarenko: You can send it to Courtney, and she’ll forward it to me. That’s fine, too. What I’m able to do is just identify weak spots we can’t tell you exactly what language to replace it with. But we’ll be able to tell you, hey? This is no good. You should get this, you know. Taken, look at, maybe, with your attorney, or something like that cause at the end of the day. It is a legal document. But I can usually tell you pretty quickly if it’s gonna stand up in either a dispute or maybe even in court

210

00:51:26.473 –> 00:51:30.412

Alex Bondarenko: because we we deal with all sorts of things when it comes to that stuff.

211

00:51:30.673 –> 00:51:40.772

Courtney McCormick: Nice, that’s huge. I know that, you know, authorization forms actually having a signature for those auto pay is imperative. So that’s huge. Alex.

212

00:51:40.893 –> 00:51:48.493

Alex Bondarenko: Okay, Dylan, come off mute. I’ve got one for you. Here’s a specific question. Does the Va. Reimburse for mileage?

213

00:51:48.973 –> 00:52:02.222

Dylan Seley: Great question. I get that question a lot. So the Va. Actually does not reimburse for mileage. So you know, depending on the situation. Whether the

214

00:52:03.233 –> 00:52:23.503

Dylan Seley: caregiver is using their own car. Nonetheless, the Va. Does not pay for mileage. They do not reimburse for holiday pay either. So I usually get those 2 questions in the same sentence. You can service on a holiday. They will pay you the normal hourly reimbursement rate.

215

00:52:23.643 –> 00:52:31.212

Dylan Seley: but they will not pay anything as far as overtime, if you, you know, pay your caregiver a little bit more to go out on a holiday.

216

00:52:31.223 –> 00:52:38.833

Dylan Seley: They will not cover that. Obviously. So, no one know. But the Va. Is very generous on their hour.

217

00:52:39.383 –> 00:52:52.423

Courtney McCormick: Okay, I have another one for you, Dylan, right away. So this person asks, I haven’t been paid for my Va client since February. Can you guys help? Okay? So this has been a trend in home care.

218

00:52:52.533 –> 00:53:14.992

Courtney McCormick: Toward the end of February one of the clearing houses the paying sources went down as big in the home care industry has rocked the worlds of many home care agencies. So did that affect you guys, Dylan. And can you help these agencies that were maybe using this other clearing house that haven’t been paid in about a month now.

219

00:53:15.533 –> 00:53:38.043

Dylan Seley: Yes, and as a matter of fact, Courtney, we have had several folks come over, and we were able to pick that up and and help them and and get them paid. And so we have not had any issues. Our connection has been strong with the Va with both try West and hop them. And so we have been able to continue to collect payments for our customers.

220

00:53:38.153 –> 00:53:49.513

Dylan Seley: so yeah, we would definitely welcome the opportunity to talk with that agency owner and see, you know where we can pick up and get them paid as quickly as possible.

221

00:53:49.663 –> 00:53:54.383

Courtney McCormick: Amazing. Y’all just send an email to that email on the screen and we’ll get you started.

222

00:53:54.563 –> 00:54:06.292

Courtney McCormick: Alex, this one is for you. Well, if there’s 2 questions I’m gonna roll them into one for you. Somebody asked. Must have been the beginning of the call. I use quickbooks for my invoicing is card connect more expensive.

223

00:54:06.293 –> 00:54:28.163

Courtney McCormick: We saw on one of your slides, Alex. That card connect and bill bill and collect using card connect is way less expensive than quick books. But the other question I want to roll into it with that Alex is, can I get a savings comparison to see if my current provider is more or less expensive than card connect. So that might be someone other than quickbooks. I don’t know.

224

00:54:28.503 –> 00:54:50.532

Alex Bondarenko: Yeah, absolutely. So we do that all the time. We get a proposal requests to answer the first part. That one is pretty easy to do, mostly just because of the rates. Methodology. We use interchange plus pricing only while quick books bundles all card rates into kind of a one flat rate.

225

00:54:50.533 –> 00:55:09.293

Alex Bondarenko: The problem with bundling all card types into one flat rate is that the flat rate has to cover the processors cost for the most expensive cards. So it it just makes it appear as if all of your clients are Jeff Bezos, using their American express unlimited card and

226

00:55:09.543 –> 00:55:24.933

Alex Bondarenko: it. It ends up costing quite a bit more, and that way you don’t get any of the benefits. So that’s that’s pretty easy for us to do like, I said in the earlier slides, about a 25% difference for some agencies. It ends up being a lot more than that, because it turns out that their clients are carrying pretty

227

00:55:24.933 –> 00:55:49.932

Alex Bondarenko: basic cards, or maybe even debit cards that they weren’t aware of. And as far as the second part of the question, yes, regardless of the payment processor you’re currently using, you can send in your last couple of months of merchant statements to myself, or just to Courtney, and she’ll forward him and typically same day. We’ll send back a comparison detailing executive

228

00:55:49.933 –> 00:55:57.262

Alex Bondarenko: how much those specific months would have cost you with access care, Bill, and collect

229

00:55:57.283 –> 00:56:00.822

Alex Bondarenko: so. And there’s obviously a lot of the benefit there. I always

230

00:56:00.843 –> 00:56:20.292

Alex Bondarenko: want to. I’m hesitant to just say, you know, hey? Yes, you’re gonna save a bunch of money. It it’s. It’s not just that. It’s so much more than that. With with access, care, Bill and collect is definitely a time element there, a security element. There’s there’s a lot that goes into it. But yes, we can definitely do a side by side comparison.

231

00:56:20.513 –> 00:56:45.233

Courtney McCormick: Absolutely. Okay. Great. Alright, this is, gonna be our last question. It’s gonna be for both of you, Dylan. I’ll go to you first. How long does it take to get signed up and started with both of these services. So let’s say, someone’s billing the Va by themselves. Someone’s running their own invoices collecting checks. And they say, I want to start today how long before they’re up and running, and you’re doing it for them, Dylan.

232

00:56:45.993 –> 00:57:14.063

Dylan Seley: So we, depending on what time of day that happens, and they contact us within normal business hours we could actually start billing the same day for that agency. So just as an example, you know, maybe we had a 100’clock in the morning meeting. Got all the information by that afternoon, before close of business we could, Bill, the Va. We would have already billed

233

00:57:14.063 –> 00:57:30.892

Dylan Seley: and send you an email, letting you know how much we have since. So it can be same day. Which is, which is really helpful to people who like in that prior example, haven’t been paid since February. You know. Getting that done quickly and timely is is what we

234

00:57:30.963 –> 00:57:49.703

Courtney McCormick: yeah, super important and just as a little note there, access care, Va. Billing is only available to access care customers. So if you’re watching this and you’re not yet an access care customer. Come on over and you can have access care va, billing, and you’re gonna love it.

235

00:57:49.853 –> 00:57:56.433

Courtney McCormick: Alex, for you. How long would it take to start using the bill and collect system with card connect?

236

00:57:56.493 –> 00:58:13.593

Alex Bondarenko: Yeah? So on our end. Similar to what Dylan said. If it’s if you’re asking, you know earlier in the day. And and we typically can stand it up same day for card processing, and that includes integrating it within access care

237

00:58:13.593 –> 00:58:41.763

Alex Bondarenko: and the user can within just a couple of hours go in there and start running credit card transactions. If they’re adding, Ach! It takes about 5 to 7 business days to actually complete the entire process of of setting it up and approving the application. So just be mindful of that. If you’re in a in a need to get it going quickly. Then the sooner the sooner you get your application in the better. But hopefully that answers it.

238

00:58:42.083 –> 00:58:58.533

Courtney McCormick: Wonderful, alright guys, we are out of time. This was so much good. Info Dylan. Alex, thank you so much for sharing your expertise with us today. Thank you for joining us. We hope to hear from you soon, and we will see you again next time.

239

00:58:58.933 –> 00:59:01.422

Alex Bondarenko: Awesome. Thank you, Courtney. Thanks, everybody.

240

00:59:01.763 –> 00:59:03.362

Dylan Seley: Take care, have a good day.