As we begin prepping and planning for another year, home care agencies should aim to focus on a crucial aspect of their operations — financial wellness. With the unique challenges and opportunities that the home care industry presents, ensuring financial stability is not just beneficial; it’s essential.

Financial Planning in Home Care

Financial planning is crucial for maintaining stability and fostering the growth of home care agencies. It involves setting financial goals and managing resources wisely to meet both immediate needs and long-term objectives. Key activities include budgeting, which ensures funds are allocated to critical areas like caregiver wages and hiring; forecasting, which helps predict future trends, such as seasonal client demand; and financial analysis, which provides insights into profitability and operational costs.

These activities empower agencies to make informed decisions that enhance financial health and support growth. For example, forecasting can reveal opportunities to expand services, while budget reviews may identify areas to cut unnecessary expenses. By staying proactive with financial planning, agencies can ensure sustainable operations, adapt to industry changes, and continue providing the best care for their clients.

Why Financial Wellness is Crucial to Agency Success

Financial wellness allows your agency to withstand unexpected market fluctuations, invest in new technologies, and, most importantly, continue providing high-quality care to your clients.

When planning for the upcoming year, it’s important to assess all financial parameters, like operational costs, overhead, and revenue streams. Ending the year with a comprehensive financial audit provides a foundation for setting realistic budgetary goals and forecasts for the new year while also allowing for the identification of areas that require improvement and potential areas for growth.

By reviewing your agency’s billing and payment processes, you can ensure efficiency and avoid any potential pitfalls or discrepancies. Implementing solutions such as point of care management software can streamline this process, saving time and reducing human error.

Viewing the new year as an opportunity to strengthen your agencies’ financial wellness will, in turn, benefit the amount of compassionate, quality care you can provide to seniors in your community.

Common Financial Challenges in Home Care

Home care agencies often face financial hurdles such as late payments, rising labor costs, and unexpected expenses. Late payments from clients or payers, like insurance companies, can disrupt cash flow, making it difficult to cover operational costs like caregiver wages. To address this, agencies can implement systems to track invoices and follow up on overdue payments promptly, while offering flexible payment terms to clients. Diversifying payer sources can also help stabilize income.

Rising labor costs and unanticipated expenses further strain financial stability. Caregiver wages account for a significant portion of expenses and maintaining competitive pay is vital for retaining staff. Strategies like optimizing scheduling to reduce overtime and focusing on employee retention can help manage these costs. For unexpected expenses, setting aside an emergency fund or allocating part of the budget for contingencies can provide a cushion. By tackling these financial challenges with proactive planning, agencies can sustain operations and deliver dependable care.

How to Achieve Financial Wellness in 2025

Achieving financial wellness in 2025 means more than just keeping the numbers in check—it’s about adapting to a shifting economic landscape with foresight and strategy. For home care agencies, maintaining a healthy cash flow forms the foundation of stability and growth. By focusing on key areas like operational costs, overhead expenses, and revenue diversification, you can ensure your agency remains robust and ready to meet challenges head-on.

This year, proactive financial management is your best tool to build resilience and thrive in an increasingly competitive market. With thoughtful planning and regular reviews, you’ll stay aligned with your goals, protect your agency’s future, and continue to provide exceptional care for those who depend on you.

Maintaining a Cash-Flow Healthy Agency

Financial wellness is an ongoing process, not a one-time task. Regularly reviewing and adjusting your financial strategies will help keep your agency on track toward long-term success and growth. Let’s continue the conversation on financial wellness by diving deeper into some key areas that home care agencies should focus on when planning for the upcoming year.

Analyze Operational Costs

First, it’s crucial to analyze your agency’s operational costs, which include direct expenses related to providing care, such as caregiver compensation, resources, the cost of onboarding and hiring new staff, etc. Start by reviewing your current budget and identifying areas where you can cut costs without compromising on the quality of care or the happiness of your staff.

Review Overhead Expenses

Next, consider your overhead expenses, which are indirect costs associated with running your agency, such as rent, utilities, and insurance. These expenses can add up quickly and may eat into your revenue if not carefully managed. Look for ways to reduce these costs by examining your lease agreements, energy usage patterns, and insurance policies.

Assess Revenue Streams

Finally, analyze the various sources of income for your agency, such as private pay clients, insurance reimbursements, and government funding.

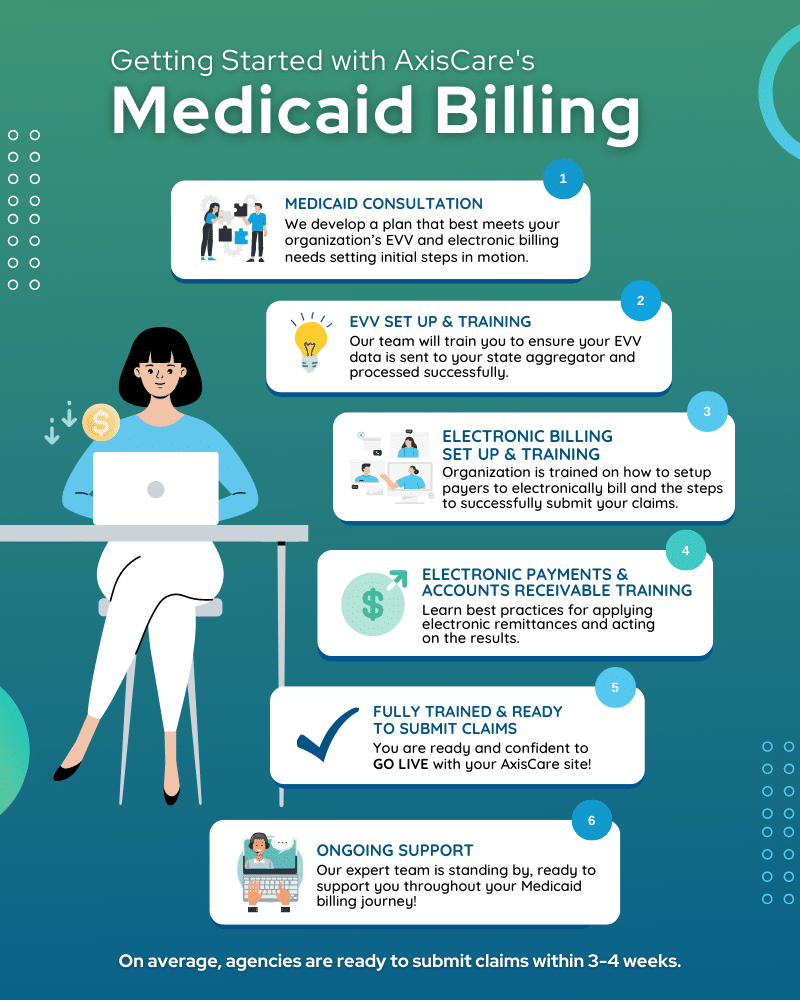

Consider diversifying revenue streams, such as expanding your services and serving a new subset of seniors, such as Medicaid or the VA. Relying solely on one source of income can leave an agency vulnerable to changes in the market. By having a diverse portfolio of revenue streams, an agency can mitigate these risks and create a more stable financial foundation. Each revenue stream comes with its own set of advantages and challenges, so it is crucial to evaluate each option thoroughly. Diversification not only provides financial stability but also allows agencies to serve a broader range of clients.

Keep Clean Data

Clean, accurate data is the backbone of effective annual planning for home care agencies. It serves as an invaluable resource, enabling agencies to make informed decisions that align with their financial and operational goals.

Not only does clean data provide a reliable foundation for our budgeting process, but it also allows agencies to accurately calculate our operational costs and revenue streams, leading to precise budget forecasts. By ensuring your data is accurate and up to date, you can confidently plan for the year ahead, knowing you’ve accounted for all potential expenditures and income sources.

Clean data also supports strategic growth. It provides insights into market trends and opportunities, enabling agencies to make data-driven decisions about expanding services or entering new markets. It allows you to gauge the potential return on investment, ensuring you’re making financially sustainable growth decisions.

Read more >> Preparing for 2025: Clean Data for Home Care Agencies

Tools & Resources for Financial Wellness

Effective planning for 2025 begins with leveraging clean, accurate data as a foundation for decision-making. Home care agencies can use data management tools to organize and analyze essential metrics, such as client demographics, caregiver performance, and financial patterns. This data helps leaders identify trends, allocate resources effectively, and forecast future needs. Clean data also ensures that strategic actions, like marketing efforts or service expansion, are aligned with the agency’s overall goals.

Diversifying revenue streams is another key strategy for long-term stability. Relying on a single income source can leave agencies vulnerable to payment delays or market fluctuations. Agencies can explore new opportunities such as private-pay services, partnerships with healthcare providers, or even offering additional services like wellness programs or senior transportation. Financial planning tools can assist in identifying and assessing these opportunities, allowing agencies to track performance and sustain growth.

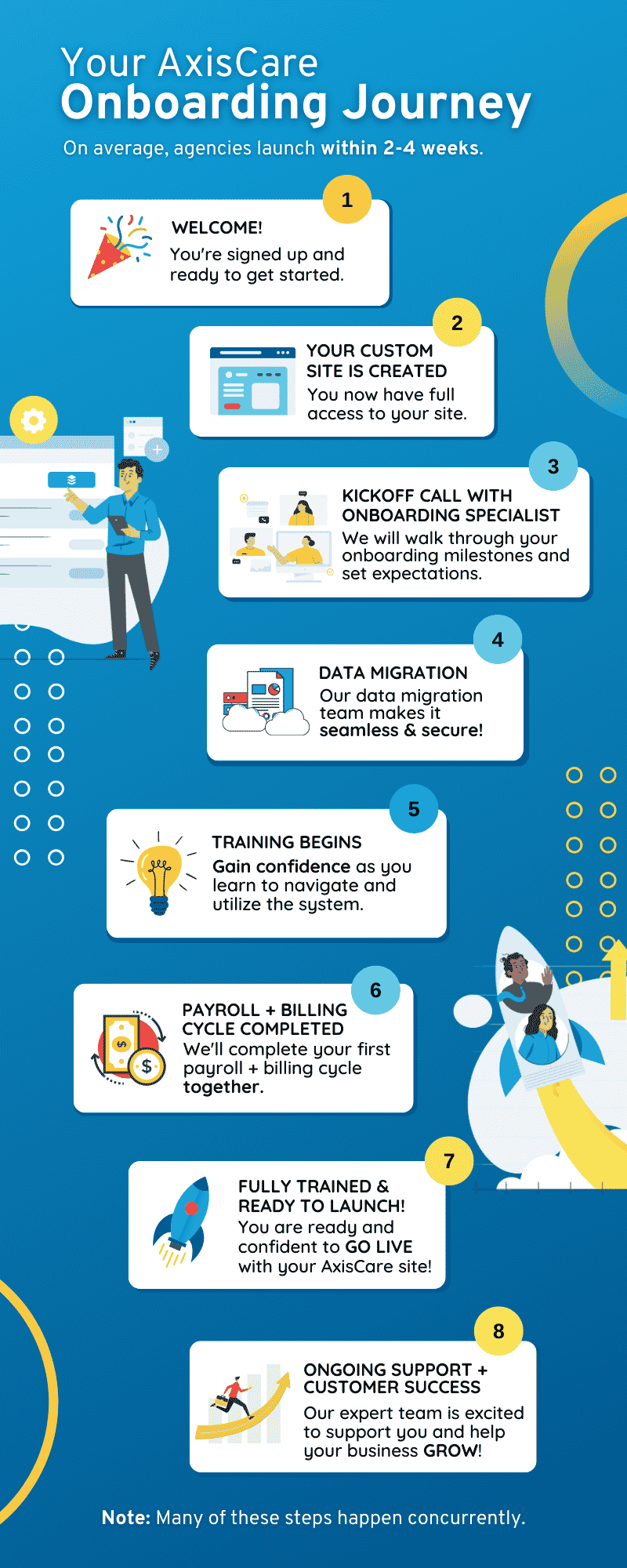

By regularly reviewing and adjusting these key areas of financial wellness, home care agencies can strengthen their financial stability. Implementing effective tools, such as homecare software like AxisCare, can play a pivotal role in simplifying operations and improving financial health. With a wide range of functionalities, including efficient scheduling, billing, and payroll systems, AxisCare offers robust reporting features and a powerful Business Intelligence tool that allows you to track key financial metrics and make data-driven decisions. AxisCare empowers your agency to reduce administrative costs, maximize revenue, and enhance service delivery, thereby strengthening your financial position.

Prepare for Financial Wellness in 2025 With AxisCare

For more information about leveraging AxisCare to sustain your agencies’ success in the new year, book a demo with one of our home care experts.