When you’re investing money in the stock market, it’s important not to sink all of your funds into one stock – because if it crashes, you’ll be in big trouble. Instead, you decrease your risk by spreading your investments across multiple stocks and asset classes. This same need for diversification applies to home care agencies and who is paying them for their services.

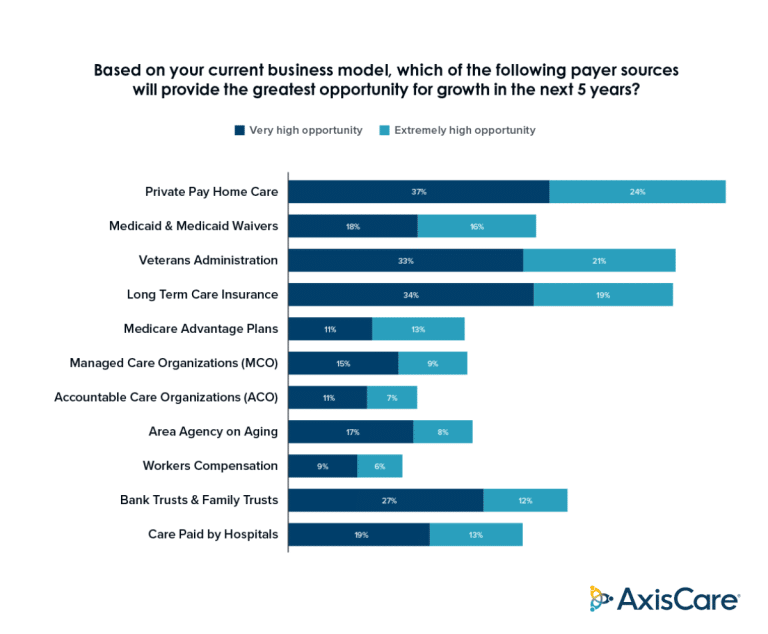

Agencies are getting wise to the fact that payer diversification is a huge opportunity. In a third-party study commissioned by AxisCare, 61% of agency respondents said private pay represented a ”Very High” to ”Extremely High” opportunity for growth, and 54% said the same about the U.S. Department of Veterans Affairs.

So, what are the benefits of diversifying payer sources and what are actionable steps home care businesses can take to implement change? Let’s dive in.

The Importance of Payer Diversification in Home Care

Relying on a single payer source can leave agencies vulnerable to changes in reimbursement rates, policies, or funding cuts. In turn, they may face financial instability and a reduced capacity to adapt to evolving market conditions. What’s more, accepting just one type of payer limits an agency’s ability to serve a broader range of clients, therefore reducing their overall revenue capacity.

Regulatory Burdens

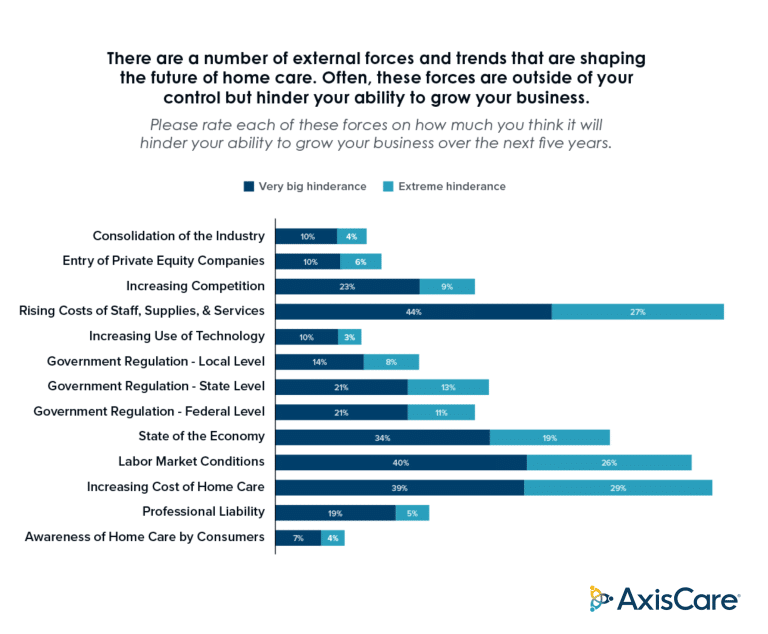

Compliance with various types of payer regulations demands meticulous documentation, training, and a constant finger on the pulse of evolving standards. The administrative burden is heavy, and failure to meet these requirements can result in reimbursement delays or hefty penalties. The aforementioned survey indicated that local, state, and federal regulations were deemed to pose a large hindrance to the growth of agencies over the next 5 years.

One such regulatory shift was legislated in April 2024, when the Ensuring Access to Medicaid Services rule (Access rule) was passed by Congress. One stipulation, the 80/20 rule, mandates that 80% of Medicaid reimbursements for home—and community-based services must go directly to caregiver wages. This change was met with resistance: industry players are worried about knock-on effects like reduced services, negative impacts on agencies in rural areas, and a lack of financial resources for other essential programs.

The Aging Population

Growing demand for home-based care puts pressure on payer structures and reimbursement models: rising healthcare costs and tighter budgets leave government-funded programs with less to give, while at the same time, more people than ever are becoming eligible for Medicare and Medicaid. In fact, the Home Healthcare Market size is expected to be worth around $797.8 billion by 2032 from $369.3 billion in 2022, growing at a CAGR of 8.2% during the forecast period from 2023 to 2032.

Understanding the Key Payer Types in Home Care

Agencies can receive payment from many sources. Each one comes with its own set of requirements and interacts a little differently with agencies.

Private Pay

Private pay is a direct revenue stream: clients pay for home care services out of pocket instead of using insurance or government assistance. This payer type gives agencies more flexibility with regards to pricing, but higher profit margins can also spell a lack of affordability for some potential clients, not to mention the manual billing efforts of tracking down lagged payments.

Medicaid

Medicaid is a program operated jointly by federal and state authorities, helping low-income individuals pay for various types of medical care. This payer type offers agencies a steady source of revenue, but it typically offers lower reimbursement rates and comes with its fair share of administrative work and regulatory requirements on a state-specific level.

Managed Care Organizations

MCOs are covered through managed care plans, which are contracted out to insurers or government agencies. This network provides a predictable source of referrals and patients, and centralized billing makes for a lighter administrative lift. However, to participate, agencies must meet certain network participation requirements, and reimbursement rates can be lower than traditional fee-for-service models.

Veterans Affairs & Other Government Programs

The VA and other government programs are tailored, respectively, to veterans and populations that are typically underserved in the world of medicine. As long as a patient is eligible, reimbursement is relatively straightforward, but joining these networks usually requires agencies to fulfill complex eligibility criteria and contend with lots of red tape.

- VA Home-Based Primary Care (HBPC) provides primary care services for veterans with complex medical needs who are unable to frequently visit a VA medical center.

- Veterans Directed Care (VDC) places eligible veterans in the driver’s seat regarding their long-term care. Patients receive a flexible budget that can be used to hire caregivers, purchase items related to their care needs, and modify their homes for accessibility.

- The Homemaker and Home Health Aide (H/HHA) assigns caregivers to eligible patients for assistance with activities of daily living (ADLs) and instrumental activities of daily living (IADLs).

- Skilled home health care services are available to eligible veterans who require skilled nursing care, physical therapy, occupational therapy, or speech therapy.

- The VA’s Community Care programs allow eligible patients to receive care from non-VA providers, including in-home care, when VA facilities are not able to provide timely or accessible services.

Long Term Care Insurance

More than half of respondents in the abovementioned study said they see Long Term Care Insurance as a “Very High” to “Extremely High” opportunity for growth. This type of insurance covers patients who need assistance with ADLs due to chronic illness, disability, or advanced age.

While it provides a reliable source of reimbursement, it can be challenging to navigate the claims process, ensure services meet policy requirements, and negotiate reimbursement rates with insurance companies.

Benefits of Payer Diversification

Payer diversification is one of the best ways to stabilize cash flow. By pulling revenue from different sources, agencies can enhance their financial stability, mitigate risks associated with reliance on a single payer, and unlock new avenues for growth and service delivery.

Reducing Dependency on a Single Payer

Having a “single point of failure” represents a large financial risk for agencies. For example, economic downswings are often associated with a reduced volume of private pay clients – but what if that’s your agency’s bread and butter? What if you rely mostly on Medicaid, but the reimbursement rules are adjusted, as was the case with the recent Access rule?

Even if you’ve been in the home care industry for years, change is bound to happen. And you don’t want to be caught out when it affects your single source of revenue.

Increasing Revenue Streams

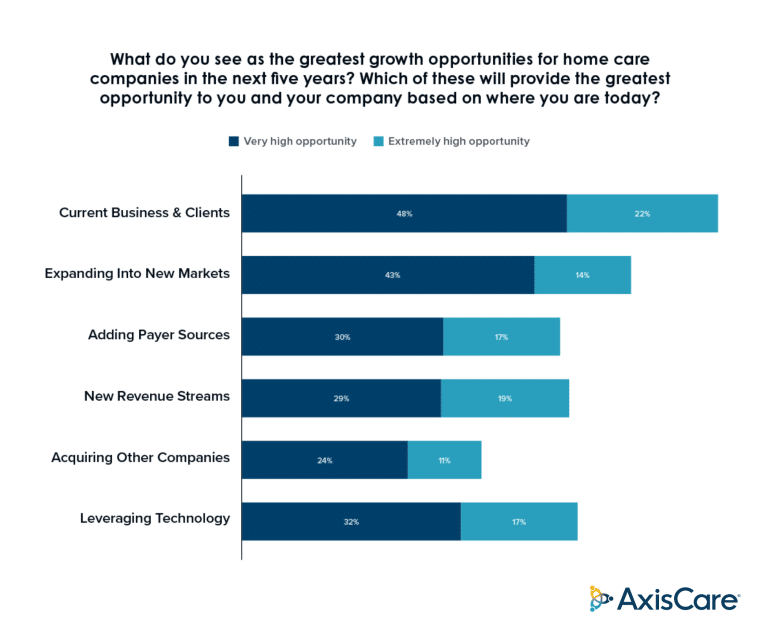

According to the abovementioned study, 47% of agency leaders say adding new revenue streams could fuel their growth. Since different payer sources cater to different patient types, accepting more payers means broadening your potential client base. While learning a new billing system can feel like a significant hurdle for admin teams, the time investment will be well worth it for the associated growth opportunities.

Enhancing Stability & Growth Opportunities

Businesses can only pursue innovation if they’re feeling confident about their finances. If not, they’ll remain in “fight or flight” mode, squirreling away every dollar in case revenue dries up. Diversifying payer sources creates a more stable and predictable flow of income, paving the way for agencies to expand, innovate, and grow their revenue even more in the process.

Strategies for Effective Payer Diversification

Luckily, payer diversification is a path that’s been walked many times before. Here are a few tried and true strategies to get on track and approach these changes wisely.

Market Analysis & Payer Mix Evaluation

Identify the proportion of clients that use private pay, Medicare, Medicaid, managed care organizations, and other payer types, then look into payer preferences and market demand to pinpoint potential growth opportunities. In a best-case scenario, agencies will do a little market research of their own to assess competitor strategies and emerging trends.

Diversifying Service Offerings

Once you’ve completed the above research, it should be clear which payer types are best suited for your expansion. This is far from a one-size-fits-all solution: some agencies may discover expansion opportunities in multiple categories, whereas others may be best served by onboarding just one new payer type for the time being. It’s about finding a balance between growing sustainably and avoiding overwhelm.

Building Strong Relationships With Payers

First comes acquisition, then comes retention. Aside from payer diversification, the best way to establish a healthy cash flow is to maintain a loyal customer and caregiver base. These clients will be more likely to refer your services to others, which will help create a more predictable revenue stream overall.

Implementing Technology for Efficiency

For agencies, it’s all about minimizing your billing cycle and getting paid as fast as possible. Home care software is designed to digitize and automate the entire process, so you can go from hard-copy cheques to auto-deposits and from chasing down unpaid invoices to pre-set payment reminders.

Leveraging Software to Expand Services & Diversify Revenue

When it comes to managing diverse payers, home health care software is a fantastic tool for getting paid faster, lightening administrative burdens, quick payment processing, and more. With more than half of survey participants naming expansion as a “Very High” or “Extremely High” opportunity for growth, software should be top-of-mind for forward-thinking organizations.

Streamlining Operations for Efficiency

Medicaid, VA, private pay, long-term care insurance, and other payer sources have their own unique requirements and processes – which can be a handful to manage manually. Using home care software, agencies can easily manage billing of all kinds, streamline claims submissions, manage authorizations, track utilization over time, and get paid faster, ultimately improving their financial health and operational effectiveness.

Enhancing Data Management for Informed Decision-Making

One of the greatest benefits of digitizing manual processes is the capacity for data collection. Software is able to quickly crunch vast amounts of information, revealing actionable insights that can help agencies make better decisions over time. From improving care plans and managing remittances to strategically targeting new payer sources, data is infinitely easier to manage when it’s unified in a single hub.

Improving Patient Engagement & Outcomes

Software tools also serve to connect patients and caregivers. Using features like two-way chat and shared dashboards, multiple stakeholders can easily communicate about care plans and share feedback. By involving patients and their families to a greater extent, agencies can improve health outcomes and overall satisfaction.

Facilitating Compliance & Accreditation

Home care software has features that automate and streamline regulatory compliance based on each payer type: for example, it can incorporate Electronic Visit Verification (EVV) for any appointment that is covered by Medicaid. Home health platforms can also track authorizations and utilization to ensure services are delivered within the approved limits.

Leveraging Software to Expand Services & Diversify Revenue

In the realm of home care, the adoption of innovative software solutions has been a game-changer for agencies aiming to enhance their service delivery and diversify revenue streams. For instance, telehealth platforms have enabled providers to offer remote monitoring and consultations. Another example is the use of advanced scheduling software, leading to streamlined operations and improved staff efficiency, allowing agencies to expand their service hours and manage more clients effectively. The importance of adopting the right software solution not only ensures survival in a competitive landscape but also sustainable growth and diversification of revenue sources.

Set Your Agency Up for Success

Diversifying your payer strategies is the gateway to increased revenue and a more stable business. At the heart of it all, the right home care software will make it easier to juggle multiple payer types, stay compliant with changing regulations, and stay on top of your billing with ease.

Ready to diversify and grow? Schedule a live demo with an expert.