The Future of Home Care: A 2024 Survey of the Home Care Industry & Future Trends

Introduction

What Will the Home Care Industry Look Like in Five Years?

What are the Factors That are Shaping our Industry?

The following report, sponsored by AxisCare, is based on an online survey of more than 200 U.S.-based home care industry leaders that was conducted by Leading Home Care … a Tweed Jeffries company, and the Homecare CEO Forum. The purpose was to gather basic facts and data about the factors affecting the future of home care and add context and analysis to provide a better picture of what this information might mean to the industry.

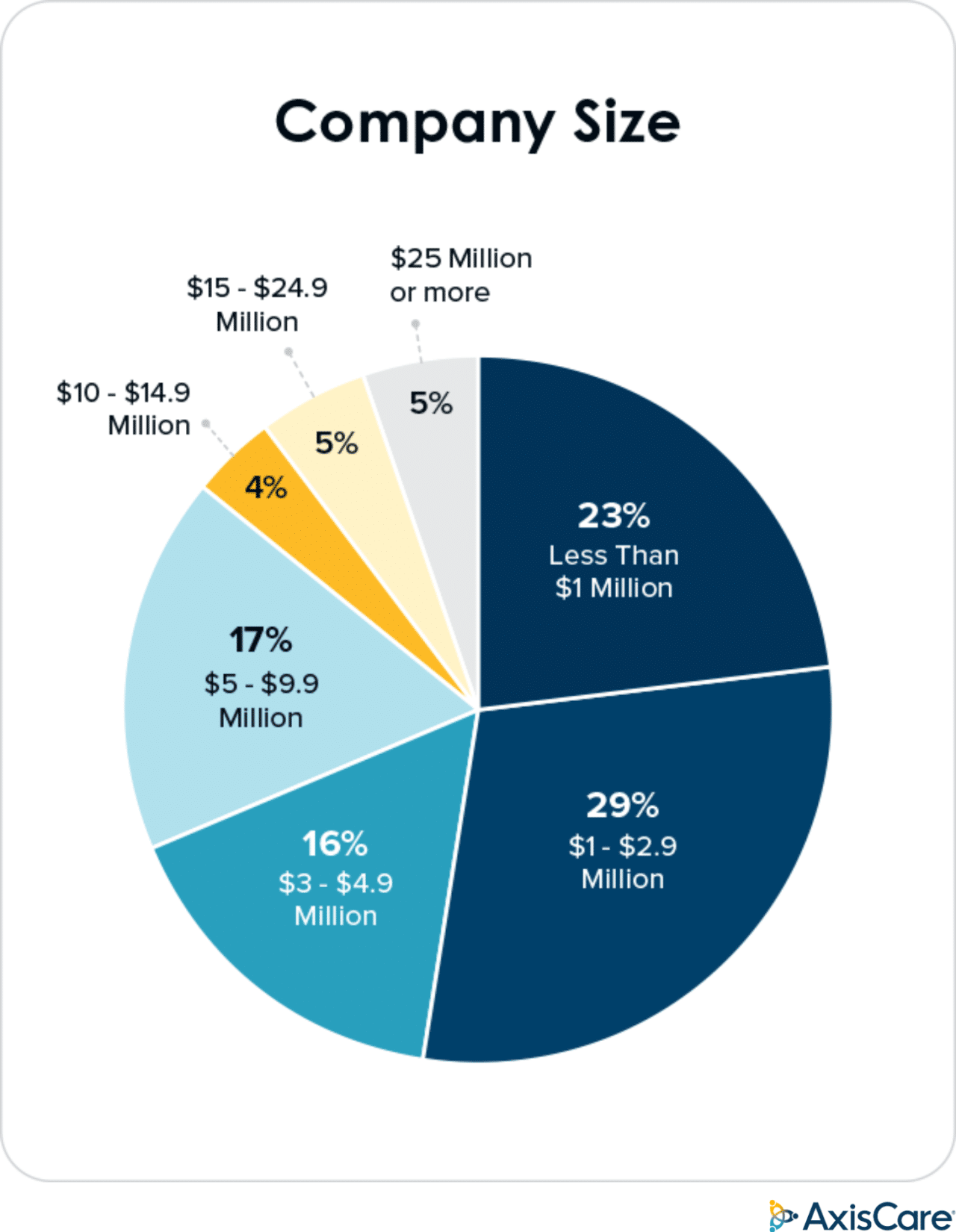

Throughout the report, readers will notice significant differences in results based on company size. Analysis reveals distinct variations in responses that correlate with the scale of operations, spanning across diverse agency sizes, from Medium-Sized Companies, defined as generating revenues between $1 million to $2.9 million, to Fast-Growing Companies, defined as generating revenues between $10 million – $14.9 million, which make up the top 5% of the industry, to Enterprise Companies, defined as those with revenues exceeding $25 million, putting them in the top 1% of the industry. By dissecting these segments, the goal is to provide actionable insights that resonate with the unique dynamics and needs of each business category within the home care industry.

To give a better picture of the relevance of this data, it is helpful to look at some facts and data about the home care industry that were compiled by Leading Home Care … a Tweed Jeffries company from a variety of sources, including the Homecare CEO Forum, Home Care Pulse, and The Franchise Times Top 400 List of franchises. It is very difficult to know exactly how many companies serve the home care industry as there are only 29 states that license home care companies and one state that registers home care companies. There are 20 states with no licensure, so it is difficult to know how many companies operate in these states.

After studying state licensure data, and tracking the number of home care companies since 2013, Leading Home Care makes this projection as to the number of companies providing in- home care to older adults and the disabled:

- Independent companies – 13,000

- Franchise companies – 7,668 *

- Affiliated companies – 5,000

* Franchise units are actual numbers based on a list of 56 companies providing home care franchises updated by Leading Home Care in April, 2023.

A special thank you to those who contributed to this research and shared their thoughts on future home health care trends.

Key Findings

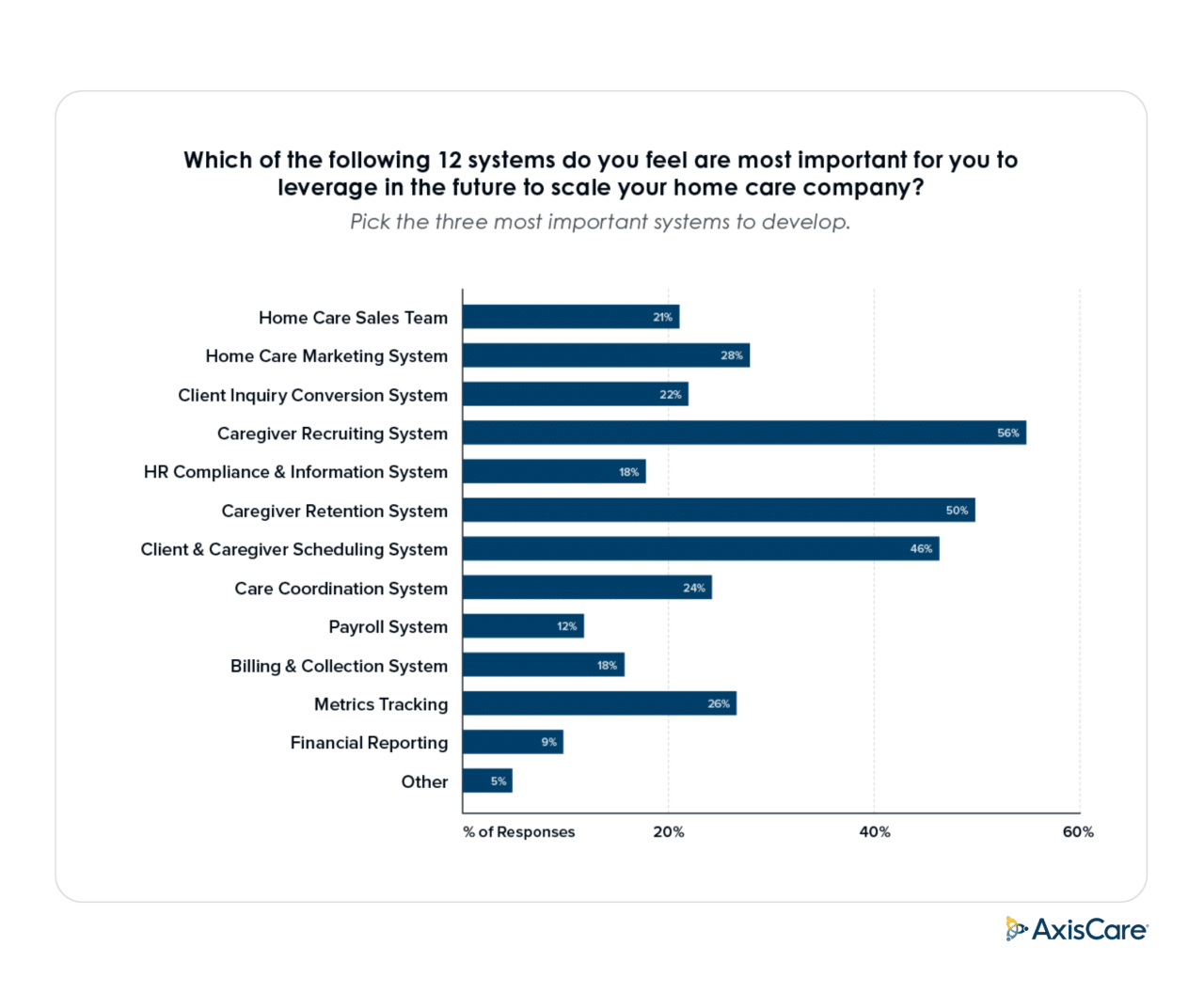

Home care leaders are systems thinkers, and the systems they want to focus on in the future are related to caregivers

When asked to select from 12 systems that have been identified as key to operating a successful home care agency, agency leaders selected the following as the most important:

- 55% want to focus on caregiver recruitment in the future

- 50% recognize a caregiver retention system as important to leverage in the future

- 46% note client and caregiver scheduling as a critical system for operational efficiency

- Enterprise Companies place a different priority on developing systems than Medium-Sized or FastGrowing Companies

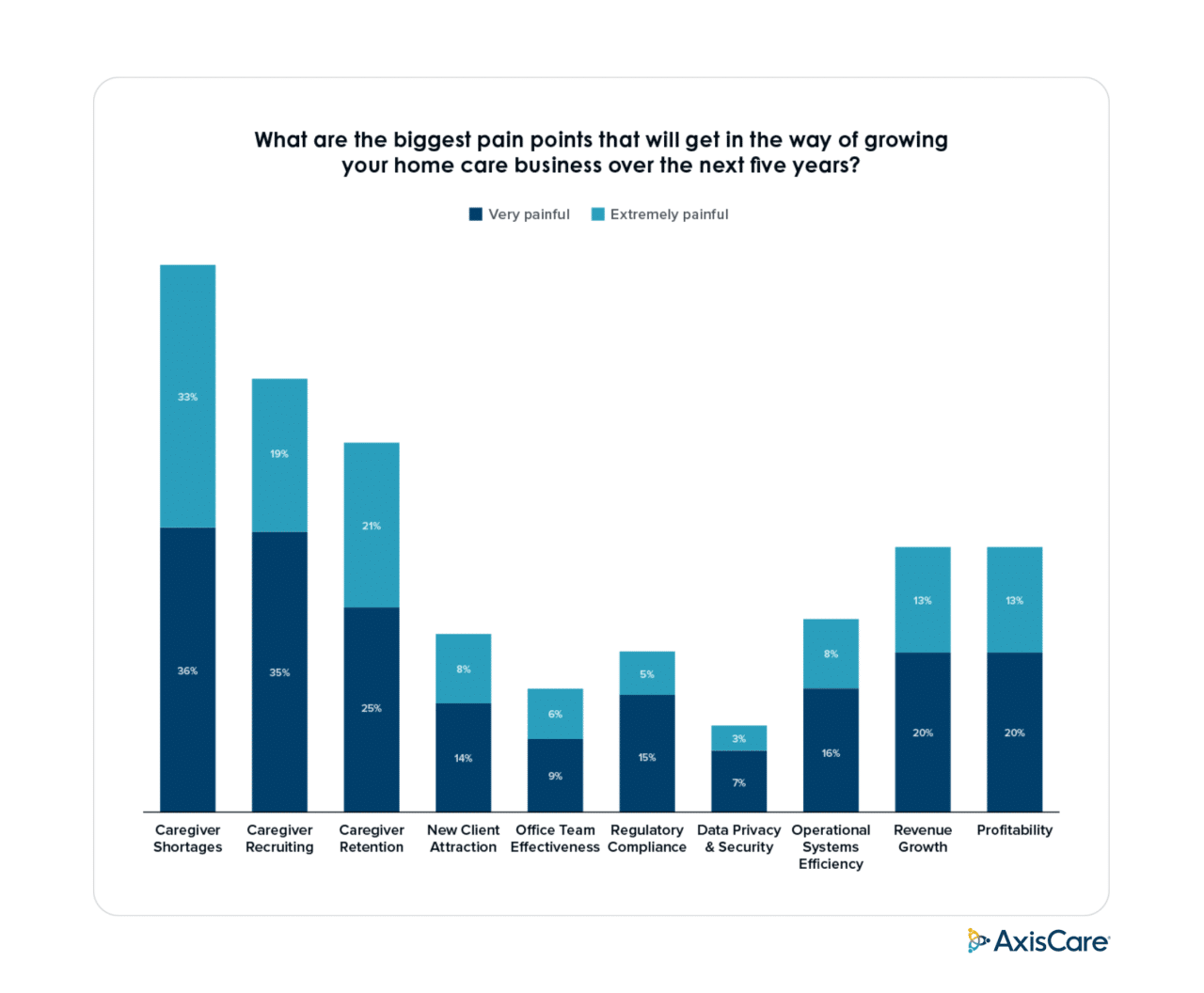

Caregivers continue to represent a key challenge, posing the biggest hurdle to company growth

When asked about the top pain points for company owners, the top results included:

- 69% of company leaders report caregiver shortages present a major barrier

- 54% encounter significant obstacles in recruiting caregivers

- 46% experience challenges in retaining staff

- These pain points shift as companies get larger

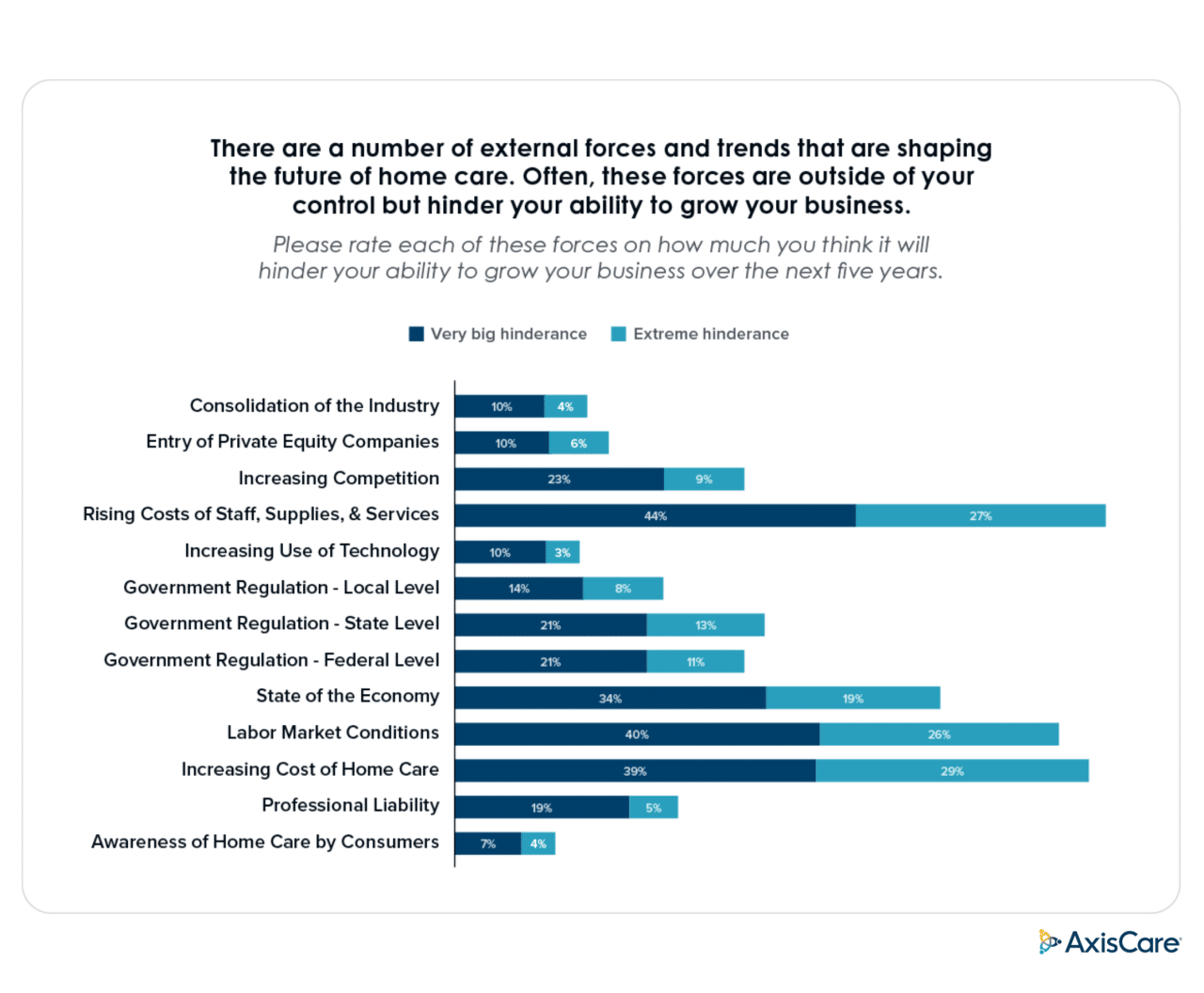

Outside forces and trends are getting in the way of growth

Noted trends that will hinder home care company growth in the future include:

- 71% view the rising costs of staff, supplies, and services as a noteworthy concern

- 69% of respondents believe that the increasing cost of home care to consumers is a hindrance

- 66% of leaders see labor market conditions as a significant external challenge

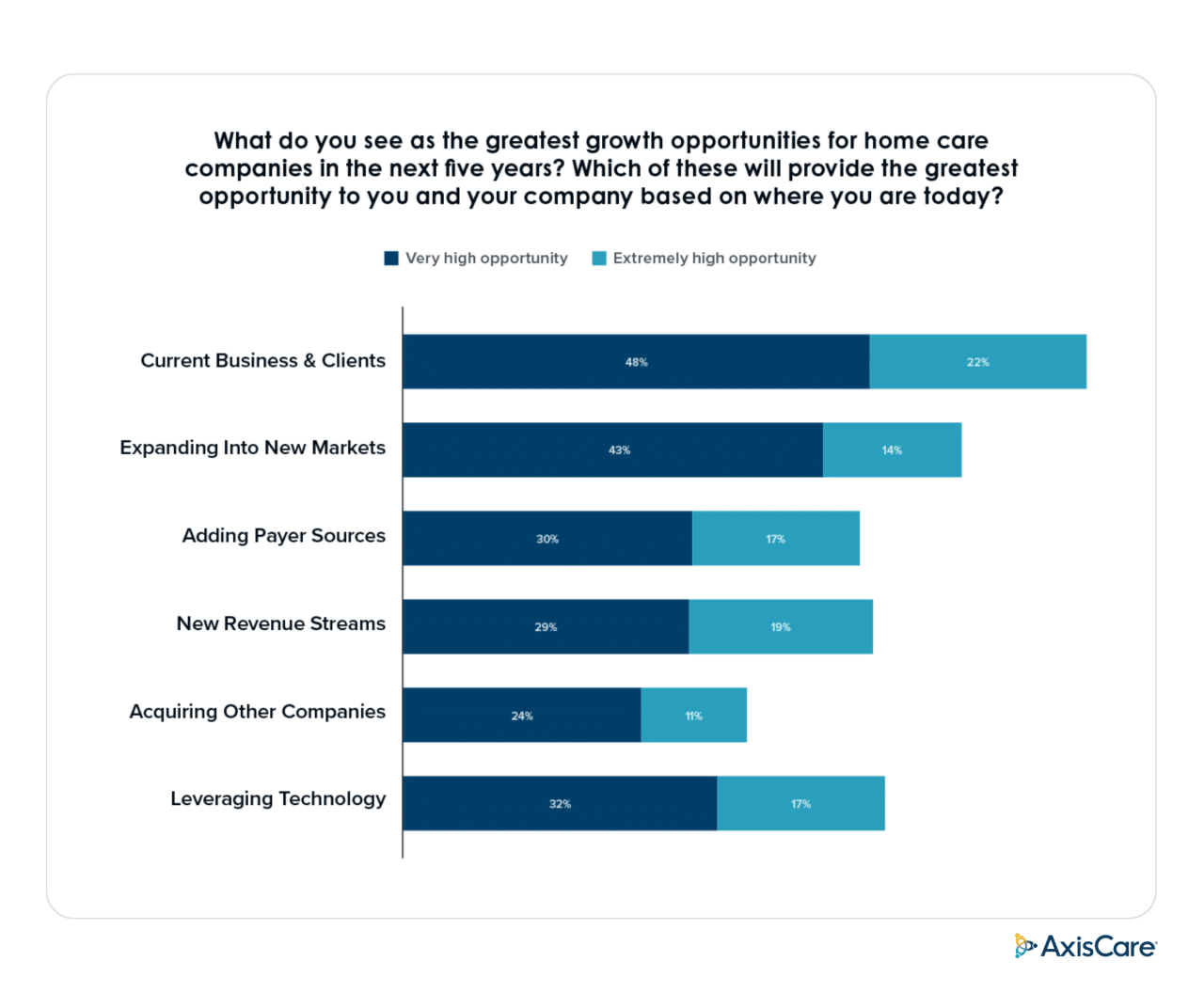

Leaders see significant growth opportunities in refining existing business operations

When asked about the greatest growth opportunities, agency leaders highlighted:

- 70% of leaders see the greatest opportunities for growth including doing a much better job within their current market and attracting new clients

- 94% recognize that expansion into new geographic territories presents an opportunity for growth

- 49% acknowledge adding new revenue streams could fuel growth

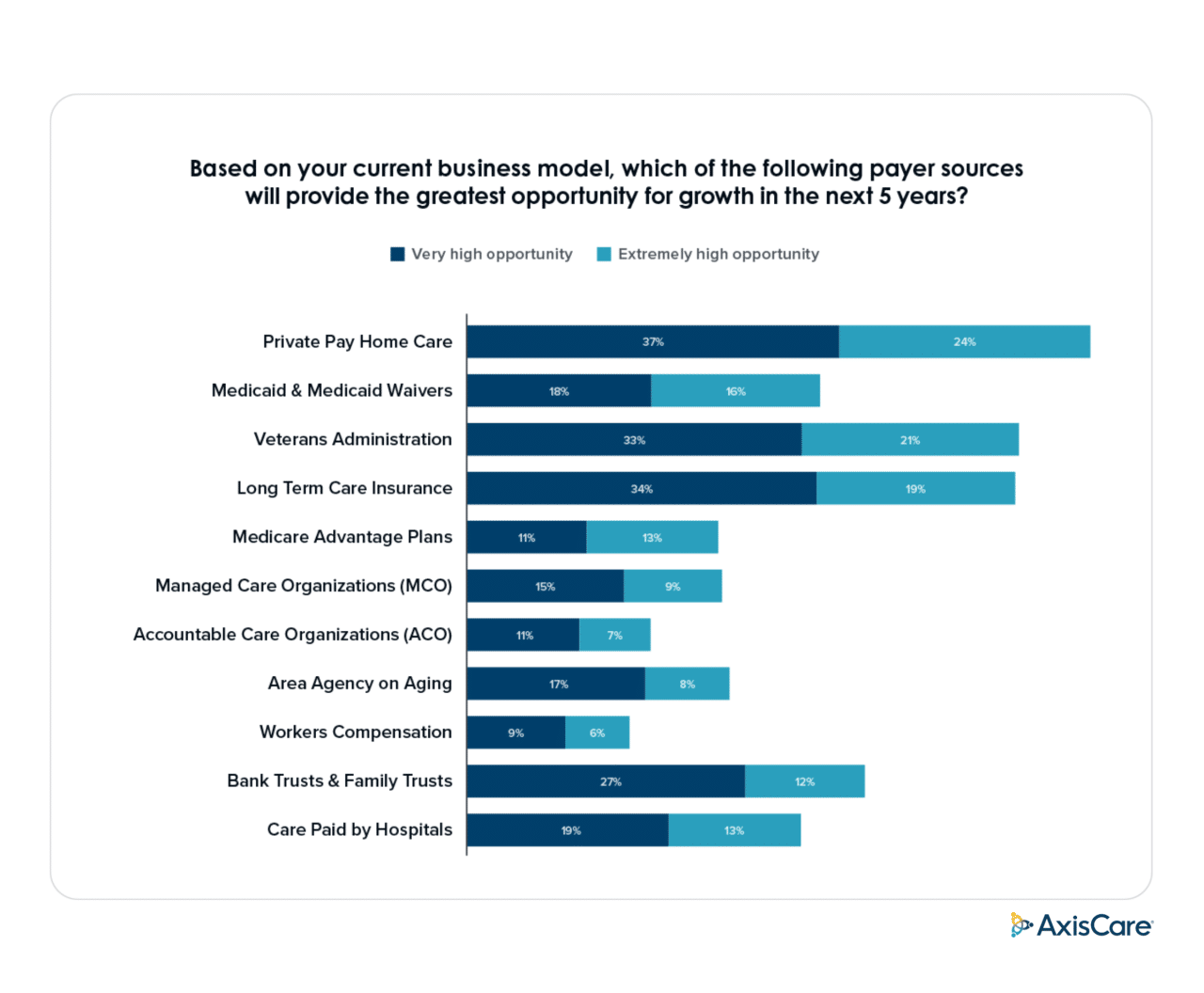

The list of who pays for home care is shifting

When asked which payer source would provide the greatest opportunity for growth, it was noted that:

- 61% of respondents identify private pay as offering significant growth potential

- 54% view the U.S. Department of Veterans Affairs as a key avenue for expansion

- 54% regard Long Term Care Insurance as a very promising opportunity

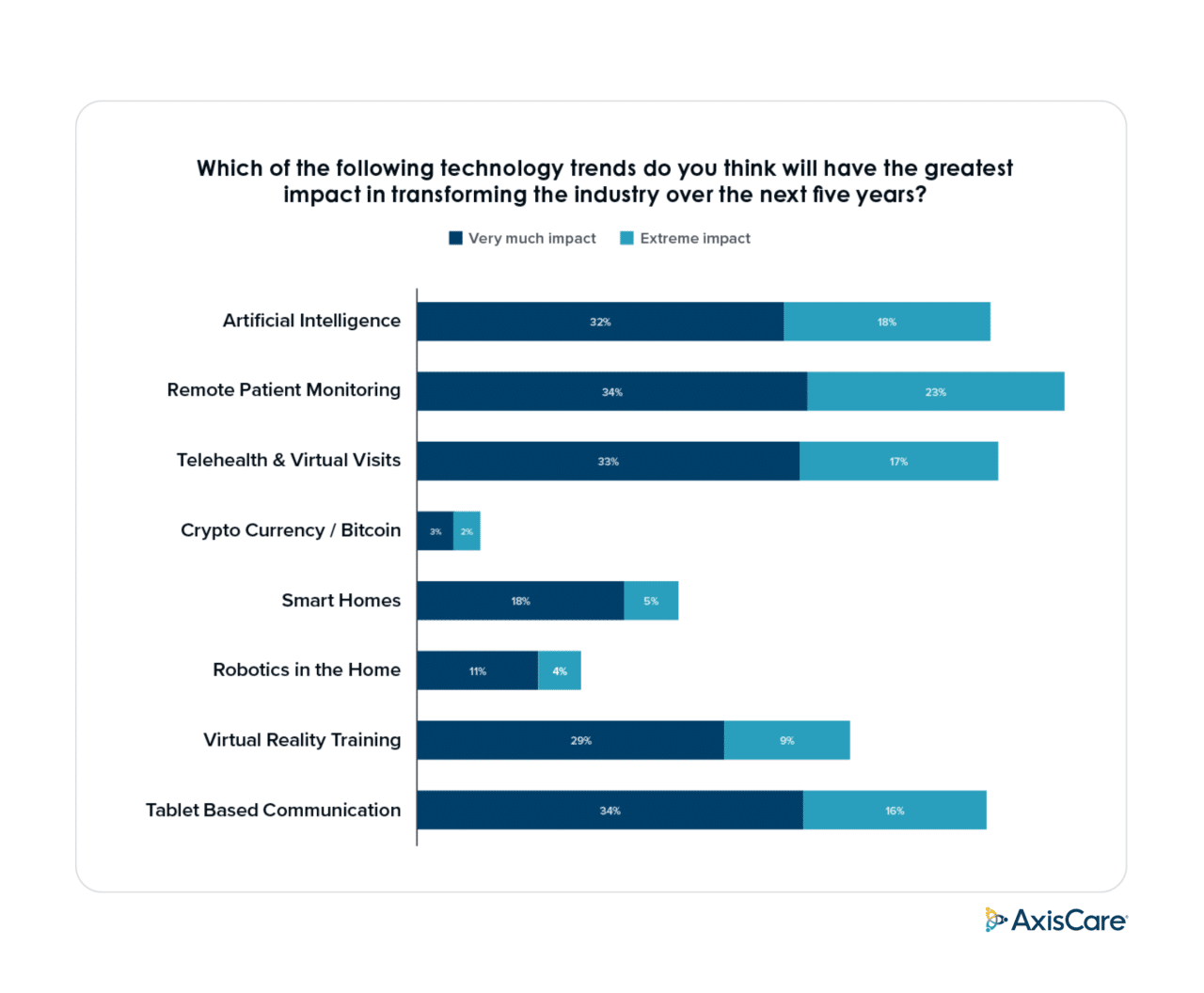

Technology will be a major factor in the future of home care

When asked which elements of technology will have the greatest impact, the trends that ranked the highest included:

- 81% of participants see Artificial Intelligence (AI) as a new technology having an impact

- 56% recognize remote patient monitoring will have an impact

- 49% believe that tablet-based communication will play a crucial role

- The Medium-Sized Companies and the Fast-Growing Companies rated this question similarly to the overall rating, but the Enterprise Companies rated AI higher on the list

Detailed Findings

Caregiver Systems for Recruiting, Retention, and Scheduling are the Major Focus of Home Care Company Owners

Research conducted by Leading Home Care… a Tweed Jeffries company, and a study of best practices in top-tier home care companies through the Homecare CEO Forum, helped identify 12 Home Care Systems to run an effective, fast-growing, profitable home care company. These systems are a combination of processes and people working together to provide repetition and consistency in the operation of a home care company.

The order of importance shifted significantly among Enterprise Companies, with their priority being caregiver retention, sales, and caregiver and client scheduling in the top three. We will see this throughout the detailed findings, where the leaders of the largest companies think differently than the leaders of Medium-Sized and Fast-Growing Companies.

The overall results for this question show the percentage of respondents who selected each system among their top three choices.

Caregivers are Keeping Home Care Leaders Up at Night

Caregiver shortages, caregiver recruiting, and caregiver retention continue to be major barriers to growing a home care company. This has been true since the first Caregiver Recruiting Study conducted by Leading Home Care in 2006, and industry thought leaders expect these factors to continue to be an issue for the home care industry for the foreseeable future.

We again see some variation in the order of these pain points as companies get larger. The Medium-Sized Companies and the Fast-Growing Companies are pretty much aligned with the overall findings. Enterprise Companies are placing much more importance on Operating Systems Efficiency, Office Team Effectiveness, and Regulatory Compliance.

This insight into the varied pain points across different organizational sizes illustrates the multifaceted nature of the obstacles home-based care businesses must navigate, highlighting that while caregiver issues are universal, the weight given to other operational challenges can differ significantly depending on the size of the agency.

Increasing Costs, Labor Market Conditions, and the State of the Economy are Shaping the Future of Home Care

In this survey, participants were provided with a list of trends and asked to indicate the impact of the trends on the future of the industry.

Fast-Growing Companies have an increased interest in private equity’s entry into home care. Enterprise Companies moved government regulation at the state and federal levels up in importance and added concern for professional liability and increasing use of technology to their top seven trends.

Again, we clearly see that as home care companies increase in size, their leaders are concerned about different industry forces and trends. Labor market conditions, the increasing cost of home care, government regulation, professional liability, and technology are much more concerning to the larger company leaders.

As the home care industry grapples with these multifaceted challenges, the emphasis on strategic financial management and adaptive operational approaches becomes increasingly evident.

The escalating costs associated with staffing, supplies, and services are paramount concerns, with a striking 71% of respondents identifying them as significant barriers to growth. Likewise, labor market conditions and the overall state of the economy are perceived as substantial hurdles by 66% and 53% of the survey participants, respectively. These findings underscore the pressing reality that financial and economic factors are the foremost obstacles confronting home-based care companies as they navigate the path ahead.

Achieving Significant Growth Requires Doing a Much Better Job in Our Current Business and Expanding Into New Geography

While the order of importance for these growth opportunities differs, all three-sized companies see this element of the future similarly. Our analysis of this question shows that smaller companies are focused on doing a better job with their current business and then expanding their geographic territory. Larger companies want to expand geography first, then do a better job and leverage innovation and technology.

Data shows the greatest opportunities for growth in larger home care companies is in expanding geographic territories, improving operational performance in the existing business, leveraging technology, and acquiring other home care companies.

These insights imply that while there is an imperative to optimize and innovate within existing frameworks, there is also a clear mandate to seek new horizons. Home care agencies should consider investing in strategies and new technologies that not only enhance service delivery and client acquisition within their current markets but also actively explore and establish footholds in new geographic areas. This balanced approach is poised to shape the future trajectory of the home care industry as companies seek to broaden their impact and reach in a competitive landscape.

Enterprise Home Care Companies are Prioritizing Payer Sources Differently

There has been much conversation in the home care industry over the past few years about diversifying payer sources. The Medium-Sized Companies and the Fast-Growing Companies see the payer sources in similar priority. The Enterprise Companies are more focused on government payers and put Medicaid and Medicaid Waivers at the top of their list, followed by the U.S. Department of Veterans Affairs and Long-Term Care Insurance.

The increasing cost of home care to individuals and to third-party payers poses a high potential threat to the future of home care as individuals and organizations explore alternatives to home care as a solution for care for older adults and the disabled. If individuals, state Medicaid programs, and the Department of Veterans Affairs decide that home care is becoming too expensive, what are the alternatives?

The data indicates a discernible stratification in the prioritization of payer sources, underscoring diverse strategic approaches to growth within the industry. Private Pay Home Care, for instance, emerges as a primary growth avenue, with a significant 61% of agencies anticipating high to extremely high opportunities. Contrastingly, while Managed Care Organizations (MCO) and Accountable Care Organizations (ACO) are pivotal players in the healthcare landscape, the data suggests a tempered expectation for growth, with less than a quarter of respondents for each payer source foreseeing high to extremely high opportunities.

Technology Will Play a Huge Role in the Future of Home Care, and Enterprise Companies are Looking More Closely at Artificial Intelligence

Technology is becoming a much larger factor in affecting the future of home care. The Medium-Sized Companies and the Fast-Growing Companies rated this question similarly to the overall rating. The Enterprise Agencies moved Artificial Intelligence (AI) to the number two spot overall on this list.

A notable 50% of respondents anticipate AI will have a substantial impact over the next five years. This pivot toward AI signals a strategic move by larger organizations to harness data-driven decision-making and automate complex processes, aiming to enhance the quality of care and streamline operations. Enterprise agencies’ investments in AI reflects a forward-thinking mindset, placing them at the forefront of advanced technology adoption.

Survey data also reveals Remote Patient Monitoring (RPM) as a leading trend. A notable 56% of participants see RPM as having substantial impact in the next five years, indicating a shift toward embracing continuous client care and proactive health management models.

Survey Methodology & Participant Demographics

In the winter of 2023 and 2024, an online survey was sent to home agency owners, executives, and employees working in the home care industry. A total of 204 qualified participants completed the survey. Participants included a mix of roles and agency sizes. Questions were asked on various topics related to the current state and future of home care. Due to rounding, certain graph options may not add up to exactly 100%.

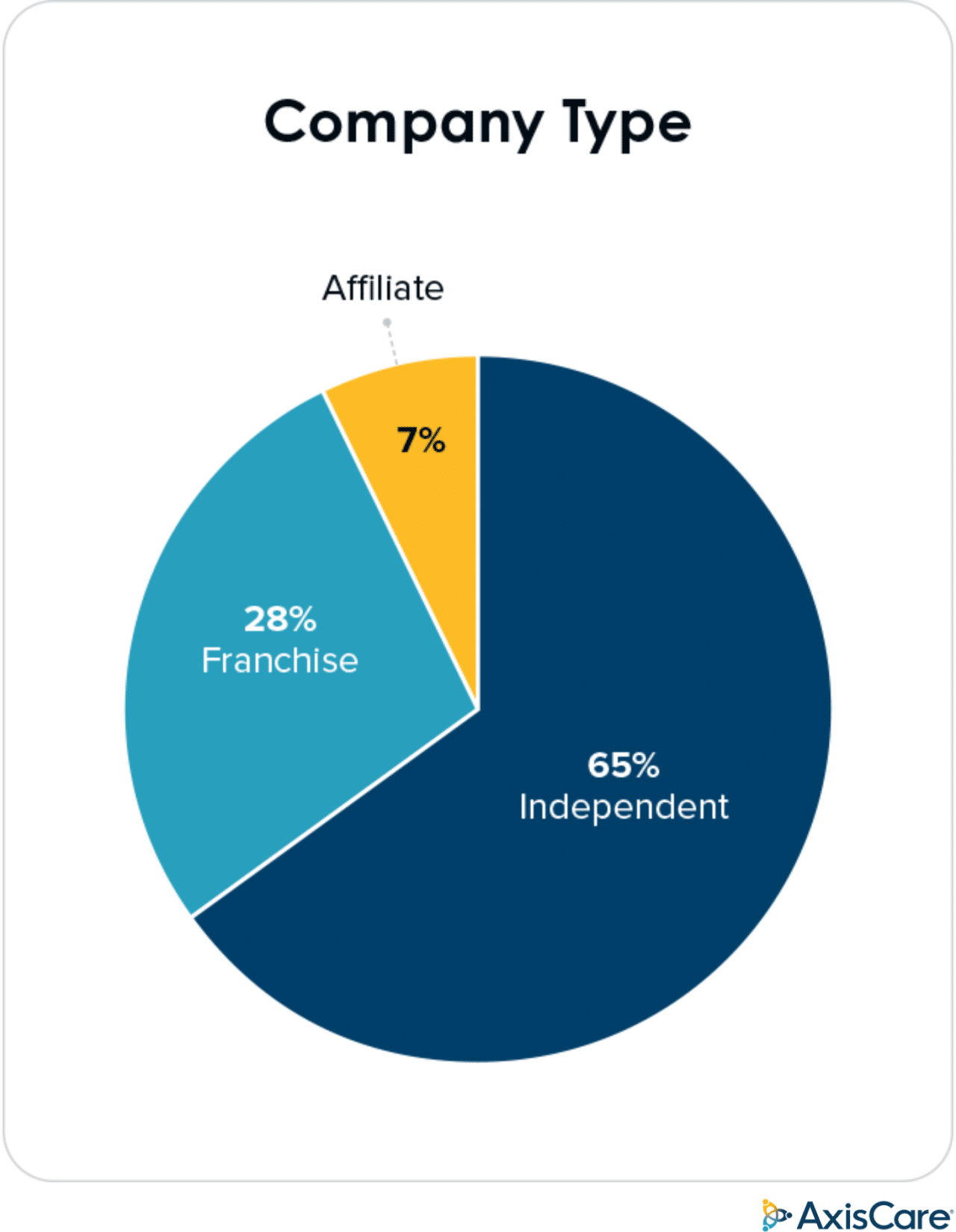

Participants by Company Type

- There are three major types of home care companies. The largest number are independent companies owned by individuals, couples, partners, or investors. They are not part of a franchise system or affiliated with any other organizations.

- Franchises are home care companies that are part of a franchise system, where they receive training, support, and engagement and use the franchise system brand.

- Affiliated home care companies are providers that are owned by or affiliated with a home health agency, hospice, senior living community, or hospital system.

- Participation in this survey was weighted toward independent agencies and with a strong participation by franchises.

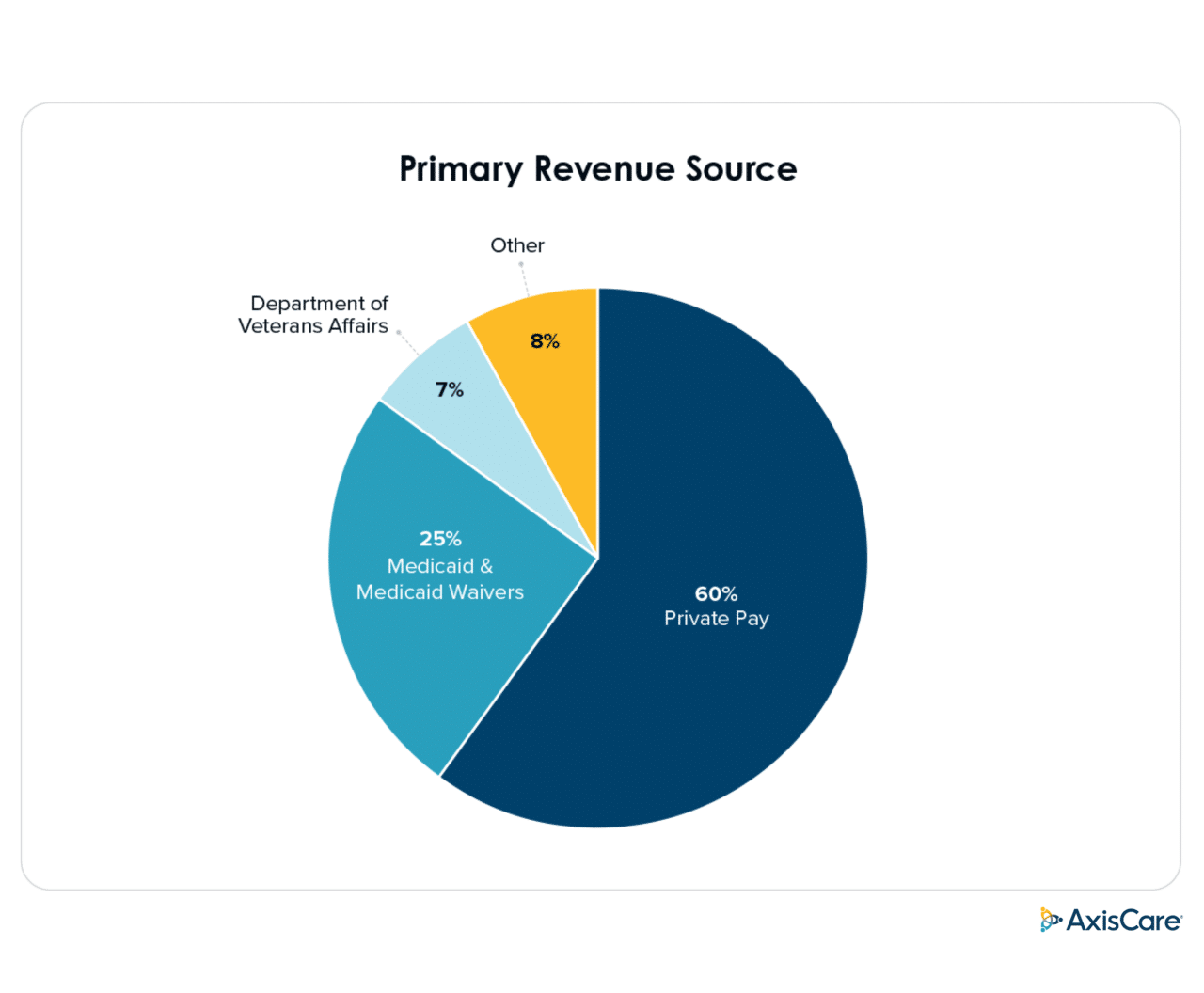

Participants by Primary Revenue Source

Over the past few years, the Homecare CEO Forum has recognized that home care companies fall into two categories: those who earn a majority of their revenue from private pay and those who earn a majority of their revenue from Medicaid and Medicaid Waiver. We divided the survey respondents by majority payer source. From this survey, we learned of a third category, and that is companies that earn a majority of their revenue from services to military veterans through the U.S. Department of Veterans Affairs.

- Private Pay – 60%

- Medicaid and Medicaid Waivers – 25%

- Department of Veterans Affairs – 7%

- Other – 8%

This information is significant in that the financial performance and statistical analysis of companies is significantly different between companies that focus on private pay and those that focus on Medicaid.

About AxisCare

As the industry’s leading all-in-one home care software solution for both single and multi-location home care agencies, AxisCare provides back-office scheduling and point-of-care solutions that help agencies in all 50 states and four countries. Specializing in Private Pay, Medicaid, VA Billing, and full-service Payroll, AxisCare’s state-of-the-art platform helps agencies track essential growth metrics, maintain a healthy cash flow, achieve effortless compliance, and gain full control of their operations so agencies can scale while staying focused on what matters most – providing the best care possible. For more information, visit axiscare.com.

About Leading Home Care … a Tweed Jeffries company

Leading Home Care is a consulting, publishing, and research firm that has been serving the Home Care Industry since 2002. Founded by Stephen Tweed and Elizabeth Jeffries, Leading Home Care has developed a pattern of serving the Home Care Industry by identifying trends and challenges facing company leaders, conducting industry research, and finding solutions. They then present their solutions and the supporting data through keynote speeches, learning seminars, online learning programs, eBooks, eTools, and research reports. In 2013, Leading Home Care introduced the Mastermind Concept to the Home Care Industry and started the first Home Care CEO Mastermind Group. Leading Home Care can be reached at leadinghomecare.com.

About the Homecare CEO Forum

The Homecare CEO Forum is a network of owners and CEOs of home care companies in the top tier of our industry who come together regularly to share ideas, solve problems, and support one another. The Homecare CEO Forum was started in 2013 by Stephen Tweed and Elizabeth Jeffries of Leading Homecare. The Forum grew to five mastermind groups and 55 member companies by 2023 when it was acquired by the Federal Way, WA firm of Jensen, Morgan, and Jones. The new owner and CEO of the Homecare CEO Forum is Jensen Jones. The CEO Forum can be reached at homecareceo.com.