Data is one of the most valuable assets for business owners. It’s used to track progress, identify areas for improvement, and make informed business decisions, but without the help of a business intelligence software it can be difficult.

Technology has made data collection much more accessible, but the abundance of statistics can lead to “data overwhelm” — a state in which business owners are unable to process and use the information effectively.

The amount of data available today is staggering. According to IBM, 2.5 quintillion bytes of data are created every day, and that number is only going to grow as more businesses adopt technology to assist data collection.

But data can only reach its potential when viewed in a framework that supports actionable outcomes. Inferring the data is not unlike using a magnifying glass: finding detailed evidence to determine your next plan of action.

Employing the best magnifying glass is just as crucial as placing it in the right position. The most successful home care agencies know how to do both.

Data is Abundant. Valuable Data is Not

Within the home care industry, it’s important to compare and benchmark the performance of an agency or organization with competitors and industry trends and norms. Home care agencies have access to a variety of data that can help them improve their business.

This data can come from surveys, social media, automated data collection tools, and scheduling software.

At a macro level, the most comprehensive industry benchmarks come from the Activated Insights Survey data. At an agency level, Business Intelligence (BI) tools offer robust reporting capabilities in operational data.

These intelligence tools build upon data collected in all-in-one scheduling software platforms that are used widely in the industry and have an edge because they can turn data into insight.

Turning Data into a Business Advantage

Data that can’t be analyzed may as well be discarded. However, data that is gathered, interpreted, and translated into better business is an unparalleled advantage.

Forrester found that “…while 74% of firms say they want to be ‘data-driven,’ only 29% say they are good at connecting analytics to action.”

That’s why it’s essential not to let data distract you from its real purpose; finding a tactical advantage that will enhance your sales.

This starts by understanding the difference between data, information, and insight.

DATA is a mere collection of facts. It’s the number of times your caregivers missed work. It’s the amount of overtime you paid last year. They are facts and figures that lack context.

INFORMATION also comes from your business data but includes the processing of your raw data. It tells you not only how many times your caregivers missed work, but when. When it calculates your overtime budget, it compares it over a span of 10 years.

INSIGHTS (or “actionable insights”) take your detailed information and convert it to profit. If your caregivers missed a lot of work over the holidays, you can resolve to offer more seasonal incentives. The next holiday season, fewer caregivers miss work. Since caregiver turnover is a leading concern, a high Caregiver Turnover Ratio can clue you in to the need for greater employee recognition and support.

Insights, in short, are the powerful end goal of data.

Take, for example, the latest trends in hospitalizations.

To keep inpatient and outpatient numbers down, Medicare has been offering reimbursement to hospitals with lowered readmissions. Because relationships with hospitals are vital to referrals, agencies who can prove—with data, information, and insight—that their services improve patient outcomes will have a distinct advantage over competitors.

Technology can Process Data into Information

Although published data shows you important benchmarks about your industry and competition, it only shows the general landscape of the home care market.

The daily operation of your agency creates a potential goldmine of more specific data that can be used to grow your business.

For example, client visits, caregiver hires, and billable hours are powerful statistics that can lead to actionable insights. But to strategically scale your agency, you must first convert that data into information.

This is where technology becomes indispensable, especially when it’s:

- Reputable

- Integrates easily with other systems

- Specific to the home care industry.

With specialized software, data is automatically collected, processed, and interpreted. The need for manual calculations and spreadsheets dissipates.

If you feel like your home care agency can subsist on rudimentary tactics and not advance to the informational level, consider this statement from Ken Stork at the Association for Manufacturing Excellence: “If you need a new process and don’t install it, you pay for it without getting it.”

Moreover, your information will start to reveal those critical patterns that become lost profit without intervention.

Solving Data Overwhelm with Insight

There are a few different strategies business owners can take to avoid data overwhelm and make sure they mine every opportunity for business growth.

One is to leverage Business Intelligence to turn information into action.

According to Forbes, “An insight that drives action is typically more valuable than one that simply answers a question–especially an insight that makes you rethink something and pushes you in a new direction.”

Focus on your business goals

The first step business owners can take with their data analytics is to determine new business goals. These might be increasing market share, reducing turnover, or expanding service options.

These pinpointed plans help business owners prioritize which metrics matter most, and then decide which tools are best for measuring that progress.

Prioritize Actionable Metrics

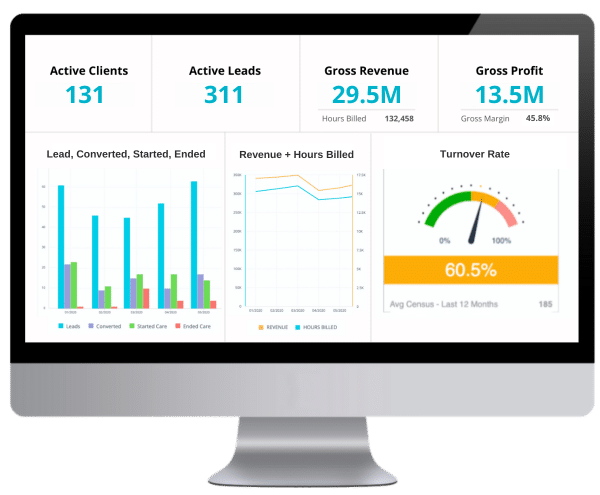

Tracking individual metrics without context is fruitless. With Business Intelligence software, you can choose a number of key performance indicators (KPI) that reflect your business objectives.

Locate your most valuable sources of information, then use Business Intelligence tools to create visual dashboards that present industry specific metrics clearly and concisely.

Essential metrics and KPIs can include:

- Gross Revenue

- Converted Leads

- Hours Billed

- Referral Source Statistics

- Gross Profit

- Caregiver Turnover Ratio

- Active Clients

- New Applicants

- Applicant to Hire Ratio

The right Business Intelligence tool is specialized to your industry and will eliminate the need to hire expensive analysts. You have instant access to charted, measurable trends.

Now for the most important part: once you’ve identified these trends, whether they reveal success or problematic patterns, you can brainstorm and enact strategic, business-improving steps.

Turning Insights into Plans

Business Intelligence software can specifically outline your next move by:

⦁ Minimizing travel time between caregivers and clients to maximize efficiency

⦁ Tracking referral sources as they evolve each quarter

⦁ Studying the margin between payable and billable overtime

⦁ Analyzing trends in caregiver turnover to improve retention

⦁ Identifying your most profitable services, and what makes them more successful

These are only a few examples of how insights direct you to profit, and as Jeanne Harris from the Harvard Business Review said, “Data is useless without the skills to analyze it.”

Those skills manifest in software solutions. Converting data into income—within a single, user-friendly program—will always be a potent tool.

With management and insight, data overwhelm ceases to even exist. When that occurs, statistics become an asset that can be immediately channeled and repurposed.

There is no getting around it…

Technology and Business Intelligence are the keys to your agency’s advancement in an increasingly competitive market.

For more information, visit www.axiscare.com/business-intelligence/

Originally posted in the 2022 Home Care Benchmarking Study by Activated Insights

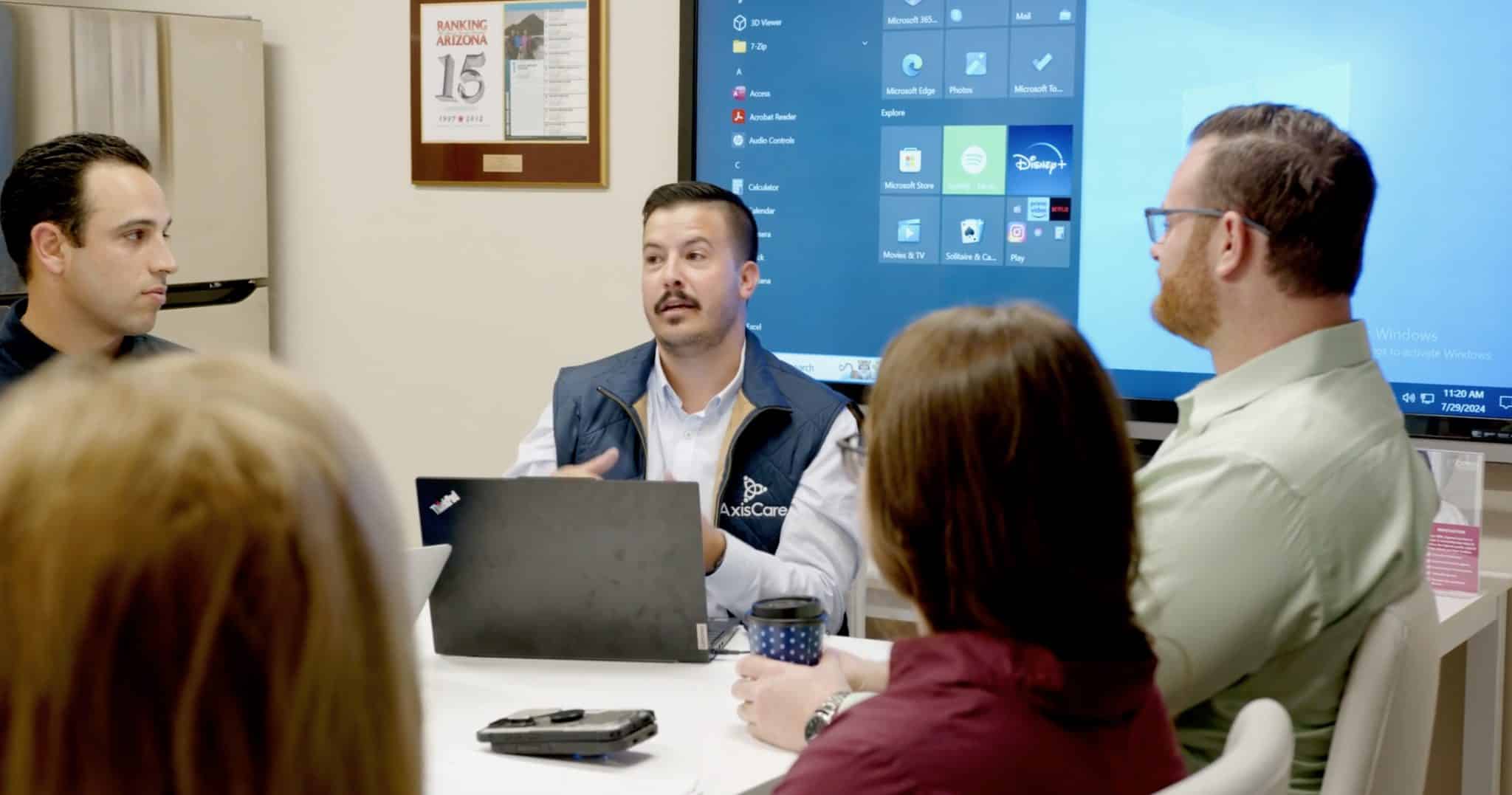

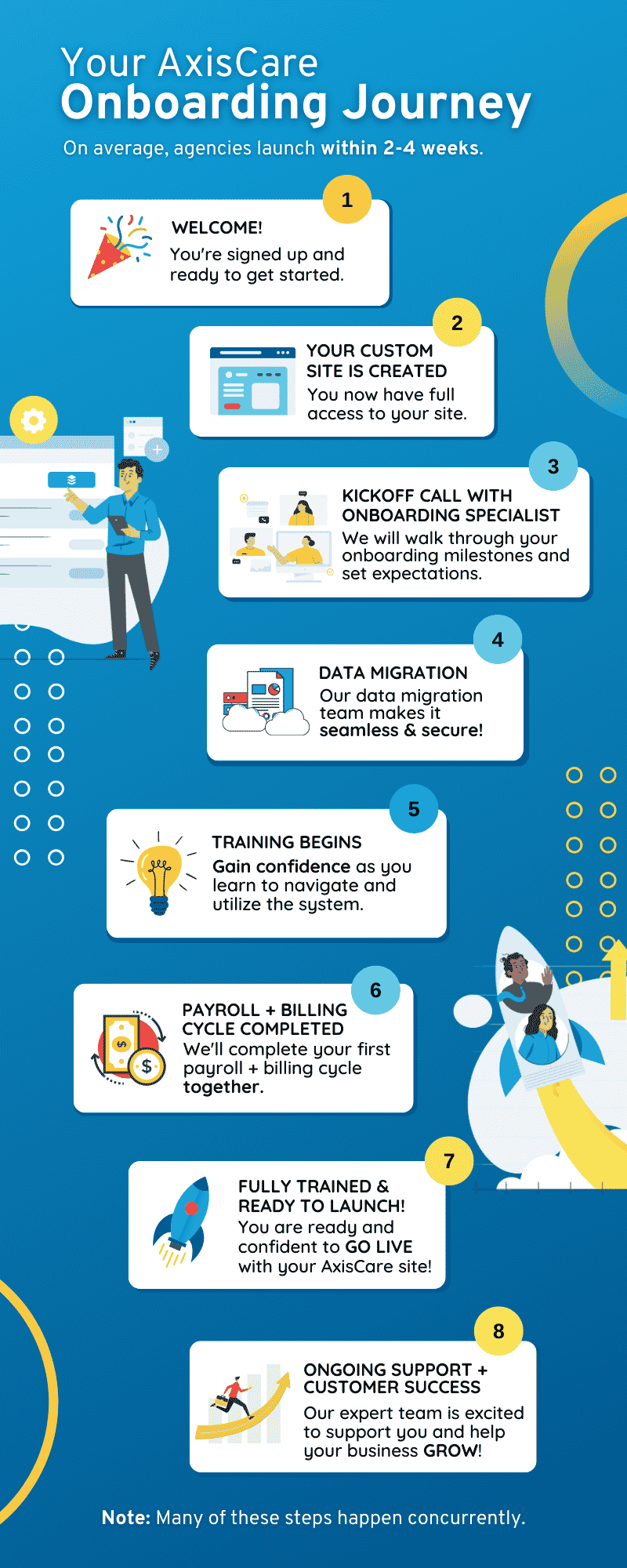

Scale with Award-Winning

Home Care Software, AxisCare

See why more than 1,800+ home care agencies in all 50 states and 10 countries are growing with the help of AxisCare. Getting started has never been easier!